Well, this is a very big question for all Malaysian trader. Today I like to shares some of my views again on our FBMKLCI, our Bursa Malaysia Stock Market. Conclusion at the end of this writings.

Let me use my own method to check on Top 30 Index counter performance first :

Ambank NEGATIVE Financial year 2016 1st quarter poor than 2015

ASTRO POSITIVE Financial year 2016 1st quarter better than 2015

AXIATA POSITIVE Financial year 2015 2nd quarter better than 2014

BAT NEGATIVE Financial year 2015 2nd quarter poor than 2014

CIMB NEGATIVE Financial year 2015 2nd quarter poor than 2014

DIGI NEGATIVE Financial year 2015 2nd quarter poor than 2014

GENM NEGATIVE Financial year 2015 2nd quarter poor than 2014

GENTING NEGATIVE Financial year 2015 2nd quarter poor than 2014

HLBANK POSITIVE Financial year 2015 4th quarter better than 2014

HLFG NEGATIVE Financial year 2015 4th quarter poor than 2014

IHH POSITIVE Financial year 2015 2nd quarter poor than 2014

IOICORP NEGATIVE Financial year 2015 4th quarter poor than 2014

KLCC POSITIVE Financial year 2015 2nd quarter poor than 2014

KLK NEGATIVE Financial year 2015 3 quarter poor than 2014

MAXIS NEGATIVE Financial year 2015 2nd quarter poor than 2014

MAYBANK POSITIVE Financial year 2015 2nd quarter better than 2014

MISC POSITIVE Financial year 2015 2 quarter better than 2014

PBBANK POSITIVE Financial year 2015 2 quarter better than 2014

PCHEM NEGATIVE Financial year 2015 2 quarter poor than 2014

PETDAG POSITIVE Financial year 2015 2 quarter better than 2014

PETGAS POSITIVE Financial year 2015 2 quarter better than 2014

PPB POSITIVE Financial year 2015 2 quarter better than 2014

RHBCAP AVERAGE Financial year 2015 2 quarter average with 2014

SIME NEGATIVE Financial year 2015 4 quarter is poor than 2014

SKPETRO NEGATIVE Financial year 2016 1st quarter poor than 2015

TENAGA NEGATIVE Financial year 2015 3rd quarter poor than 2014

TM NEGATIVE Financial year 2015 2 quarter poor than 2014

UMW NEGATIVE Financial year 2015 2 quarter poor than 2014

WPRTS AVERAGE Financial year 2015 2 quarter poor than 2014

YTL NEGATIVE Financial year 2015 4 quarter poor than 2014

(when i do this, I just glance very quick, mistake is possible)

17 NEGATIVE result, 11 POSITIVE result, 2 AVERAGE result.

This show that our TOP 30 giant index link counter are mostly not doing great. It's tell why our market start to fall right after all May quarter result released. Will this company recover in coming month? I felt very unlikely !!

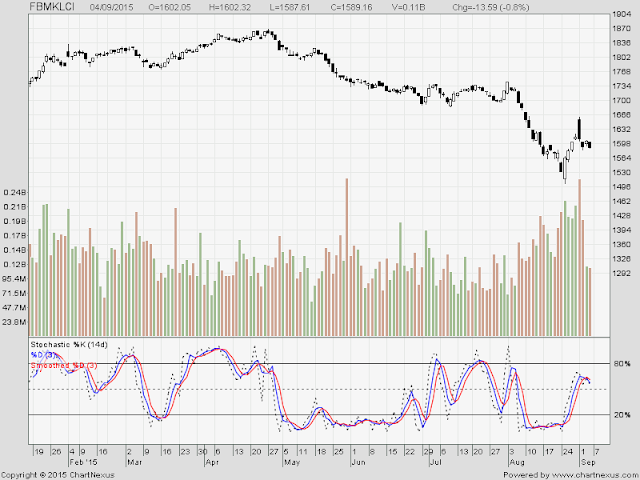

Let us look at FBMKLCI daily chart. hanging around 1589.16. There is one very big volume down candle happen, a big gap up and close red on 1/9/2015. For me, I think this is a deadly candle It's very hard to be able to climb above this candle, which is 1660.22.

What weekly chart say? I only can say, I saw two very big black down candle. It's telling me there have been 2 week, that index fall so badly. If there is another week big black down candle, I am pretty sure, our FBMKLCI is hopeless already, and very very high chance to break 1500. Why all this happen ? Just because of poor result? No, it's too many bad egg spoil the soup.

Lets look at our iShares MSCI Malaysia ETF that listed in NYSE Arca.

The iShares MSCI Malaysia ETF seeks to track the investment results of an index composed of Malaysian equities.

2. Targeted access to 85% of the Malaysian stock market

3. Use to express a single country view

And you see what happen to its price. 52 week high at 16.15. Now only traded soon half at 9.64, last Friday drop another 3.5%. It's express a very bad view for Malaysia stock market. .

Let us look at our USD/MYR, it's MELETUP and break new HIGH ! Wow !

I not yet even mentioned about Interest rate, China economy slow down, Political problem, Country Debts, which all seems to be negatives to us.

Until here, I have my conclusion that, I think our FBMKLCI, and our stock market are seriously doing very badly because:

1. Most of the index counter have poor result.

2. Technically index are very bearish.

3. RM depreciate too fast that cause many problem.

4. Many others big issues will impact Malaysia Economy.

5. Foreign fund have no reason to stay.

6. Government fail to improve efficiency.

What we can do with our stock market ? Still any way to trade ? It's covered in my Facebook and telegram group chat. Welcome to add me.

My short term target on FBMKLCI at 1500, medium 1400, bottom if worst happen 1100-1300.

No comments:

Post a Comment