Bookmark this blog/link and re-visit often for ideas/opinions/views on making $money$, from the Stock market, Forex, Commodities, Internet Business, etc.

Friday, December 18, 2015

Uncle Z

I believed I came across Uncle Z in i3Investor forum many many months ago ....but when I went to his blog he did not update his blog for some time ...

So I thought he got tired and disappeared from blogging on stocks for good.

Today while reading an article I saw a link to Uncle Z blog and went to have a look ...hey he is back.

For those who do not know Uncle Z, I think he is a senior much much older than me, ha-ha.

He write about stocks and give some cun tips too ...much better than OngMali Blogspot ...ha ha ...here is the link to his blog >>> UncleZ on Value Investing

Happy reading and to Uncle Z ...welcome Back!

Tuesday, December 15, 2015

Saturday, December 12, 2015

Summary of Profit Tracking

As a follow-up in a previous article, I went ahead and did the following analysis on my top 5 profit stocks:

1. Frontkn 53.9%

2. Denko 12.4%

3. PPHB 11.7%

4. Xinhwa 6.6 %

5. Krono 4.3%

**(Open a spreadsheet or write in a personal trade diary)

1. Put in the stock code.

2. Write down where did I found the trade/stock.

3. Describe the profit.

4. What did I learn?

5. How can I improve?

-----------------------------------------------------------------------------------

1. Frontkn (0128)

2. Saw an article in i3investor by (Icon8888) Frontken Corp - Semiconductor Division Doing Well dated 17/2/2015.

3. Saw the stock in a Rounding Bottom chart pattern. USD beneficiary due to subsidiaries in Taiwan, China and other SEA countries. First bot on 18/2 average around 0.188 cent. In April it started the breakout from the bottom. Bot and sold couple times and last sold at 0.31 cents.

4. I learnt to look out for Icon8888 articles and to look for Rounding Bottom chart patterns.

5. Should not have bot and sold a couple of times as I had to re-enter again at higher prices and high risk getting trapped!

1. Denko (8176)

2. Saw an article in i3investor by

(Icon8888) Denko - Smallish Plastic Parts Manufacturer Expects Better Year Ahead on 16/7/2015.

1. Put in the stock code.

2. Write down where did I found the trade/stock.

3. Describe the profit.

4. What did I learn?

5. How can I improve?

-----------------------------------------------------------------------------------

FRONTKN

1. Frontkn (0128)

2. Saw an article in i3investor by (Icon8888) Frontken Corp - Semiconductor Division Doing Well dated 17/2/2015.

3. Saw the stock in a Rounding Bottom chart pattern. USD beneficiary due to subsidiaries in Taiwan, China and other SEA countries. First bot on 18/2 average around 0.188 cent. In April it started the breakout from the bottom. Bot and sold couple times and last sold at 0.31 cents.

4. I learnt to look out for Icon8888 articles and to look for Rounding Bottom chart patterns.

5. Should not have bot and sold a couple of times as I had to re-enter again at higher prices and high risk getting trapped!

DENKO

1. Denko (8176)

2. Saw an article in i3investor by

(Icon8888) Denko - Smallish Plastic Parts Manufacturer Expects Better Year Ahead on 16/7/2015.

3. Saw the stock in a Rounding Bottom chart pattern. FA - recently turnaround from losses. It is a USD beneficiary. I like small share base so I thought that chance of big move is higher. Took a big risk and bot on 23/7 at 0.37 cent & it rallied to 0.475 cents. Sold at 0.44 cents.

4. Seems like something I should have learnt already - read Icon8888 articles and to look for Rounding Bottom chart patterns.

5. Took a big risk - next time either get in early or forget the trade. (Icon8888 article the price at 0.30 cents and I bot at 0.37 cents.) Didn't know it that time but 0.475 cents was the highest point ever.

PPHB

1. PPHB (8273)

2. Lucky pick when looking through the trading platform for a packaging stock. This stock has not moved much yet, still below RM1.00

3. Saw the stock in a Ascending Channel chart pattern. The stock is profit making all the years and is a USD beneficiary. First bot at 0.982 on 13/11 and last sold at 1.15 on 23/11 (bot and sold a couple of times). Was pure luck as the stock reported lower quarter earnings the next day and the following day gap down. So far never recovered to this price.

4. I learnt to look for Ascending Channel chart patterns. I guess correctly the rally was due to the impending quarter results.

5. Took a big risk as the Ascending Channel has been going on since the August big drop! Next time must find something earlier.

XINHWA

1. Xinhwa (5267)

2. New IPO listing on 30/6. I believe I was influenced after reading an article in i3investor by kiasutrader - Xin Hwa Holdings Berhad - The Efficient Land Transporter on 30/6/2015.

3. The stock is Main Board with a small share base (180mil). I like small share base as it can go far. It open strongly so I thought it will go far at least RM1.00. First bot at 0.87 on 1/7 (2nd day) and sold last at 0.99 on 13/7.(Later on the stock chart look like an Ascending Channel pattern ya.)

4. I learnt to look for new IPO listings. Some could go far like Xinhwa.

5. Bot early but sold too early too. Should have let it run until the stock say sell. It went up to a high of RM1.46

KRONO

1. Krono (0176)

2. I believe a friend told me to buy this stock. Later I check and saw an article in Sun that Public Bank is one of their customer.

3. The stock has a Rounding Bottom chart pattern after the market sharp drop in Dec 2014 & Jan 2015. It was rebounding so I felt quite confident to buy. Bot at 0.245 cents and sold at 0.27 cents on 6/2. Contra trade.

4. I was quite confident to buy as the stock had dropped sharply and rebounding (Rounding Bottom). Low at that point was around 0.19-0.20 cents.

5. Sold too early. Should have let it run until the stock say sell. It went up to a high of 0.415 cents.

Conclusion

Hope you liked the analysis and will benefit from this. There were many other stocks I've made money on but because the profits were tiny I see not much benefits to analyse them.

So to summarized as follow on my top 5 profit stocks >>

1) Read Icon8888 articles (LOL!)

2) Look for Rounding Bottom stocks

3) Look for Ascending Channel stocks

4) Look for USD beneficiary and exporter stocks.

Thanks for reading and if you like more articles in the future, join me at Ong Mali on Facebook.

Sunday, December 6, 2015

Profit Tracking

Hi all, its' already December ... how time flies!

I doubt I will make a lot of trades till year end so why not take the time to recap all my trades for the year.

This article is all about Profit Tracking. The next article will be on Loss Tracking.

Profit Tracking

Profit tracking simply means analysing the profitable trades you have made over the year.

By analysing the trades, it could help us traders learn how to become more successful in the market place.

I will pick my top 5 Profit trades and see how it stack up to the overall total profit I've made -

1. Frontkn 53.9%

2. Denko 12.4%

3. PPHB 11.7%

4. Xinhwa 6.6 %

5.

Total = 88.9% !

Wow ... only 5 stocks and they oredi contributing a whopping 88.9% of my total profit.

So, what's next? ...

You will need to further analyse all these 5 stocks and trades ... to determine how did the trades became a success ...and hoping you can repeat this trick over and over again.

The Mechanics Involved in Profit Tracking

1. Open up a spreadsheet.

2. Put in the stock code.

3. Write down where did I found the trade/stock.

4. Describe the profit.

5. What did I learn?

6. How can I improve?

If you are not lazy like me, you can write a trade journal to record all the trades and after each month ended, you do the profit tracking analysis.

In my analysis, I choose the top 5 stocks because I oredi know only a few stocks contributed to most of my profits. I also do not trade much every month, maybe that why the results could be distorted.

If you have a more evenly profit contribution, and trade a lot, you have more stocks and can choose top 10 or 15 stocks.

Remember the whole purpose of this analysis is to become a better and more efficient trader or investor in the stock market.

All the best!

GA

Saturday, November 14, 2015

Oil is going lower ...and lower ..

Seems like what this guy is saying that oil prices will go lower and remain low for at least till March-April 2016 (early spring).

Source : http://blog.smartmoneytrackerpremium.com/2015/11/charts-of-the-day-25.html

Monday, November 9, 2015

The US Dollar Bull Market Could Trigger a $9 Trillion Debt Implosion

The US Dollar rally, combined with the ECB’s policies and the Fed’s hint at raising rates in December, is at risk of blowing up a $9 trillion carry trade.

When the Fed cut interest rates to zero in 2008, it flooded the system with US Dollars. The US Dollar is the reserve currency of the world. NO matter what country you’re in (with few exceptions) you can borrow in US Dollars.

And if you can borrow in US Dollars at 0.25%... and put that money into anything yielding more… you could make a killing.

A hedge fund in Hong Kong could borrow $100 million, pay just $250,000 in interest and plow that money into Brazilian Reals which yielded 11%... locking in a $9.75 million return.

This was the strictly financial side of things. On the economics side, Governments both sovereign and local borrowed in US Dollars around the globe to fund various infrastructure and municipal projects.

Simply put, the US Government was practically giving money away and the world took notice, borrowing Dollars at a record pace. Today, the global carry trade (meaning money borrowed in US Dollars and invested in other assets) stands at over $9 TRILLION (larger than the economy of France and Brazil combined).

This worked while the US Dollar was holding steady. But in the summer of last year (2014), the US Dollar began to breakout of a multi-year wedge pattern:

Why does this matter?

Because the minute the US Dollar began to rally aggressively, the global US Dollar carry trade began to blow up. It is not coincidental that oil commodities, and emerging market stocks took a dive almost immediately after this process began.

The below chart shows an inverted US Dollar chart (so when the US Dollar rallies, the chart falls), Brazil’s stock market (blue line), Commodities in general (red line) and Oil (green line). As you can see, as soon as the US Dollar began to rally, it triggered an implosion in “risk on” assets.

Indeed, the US Dollar as broken out of a MASSIVE falling wedge pattern that predicts a multi-year bull market.

Source: http://www.zerohedge.com/news/2015-11-09/us-dollar-bull-market-could-trigger-9-trillion-debt-implosion

Sunday, November 8, 2015

LCTH in Ascending Channel ...Pt 2

Teaser: Could this example be the chart of LCTH in the future ? We hope so.

Take note that LCTH is "expected" to announce their quarterly results this week, on Nov 13th, this Friday (AMC - after market close) - I based this date on the last 3 years 2012-2014 where quarter results were released on Nov 14th and in second week of November.

IF the results are good, I hope LCTH can breakout from this current channel (red arrow, see diagram above).

Disclaimer: I currently do not hold any LCTH stock but could initiate a position next week. This is my personal view and I could be wrong on the outcome. Trade at your own risk!

Saturday, November 7, 2015

ValueCap to pick firms from six key sectors

Read More : http://www.nst.com.my/news/2015/10/valuecap-pick-firms-six-key-sectors?utm_source=nst&utm_medium=nst&utm_campaign=nstrelated

Saturday, October 31, 2015

October 31 : 5 Things to know

1. Today is Halloween Day in the US. Lots of fun where people wear costumes and do pranks on each other. Some people think today the spirits will be released and allowed to roam a day before All Saints Day on November 1.

2. This week the KLCI Index dropped every day from Monday to Friday. Index seems very bearish (yet) the small cap and penny stocks rallied. Small is beautiful they say. Is November going to be like this too ???

3. Oil prices have rallied despite all the oversupply, strong USD, OPEC no action blah blah blah. Oil post first positive week in 3 and gain 4%. Oh because of this, when you go out later, please pump more petrol for your car. You can expect an increase in petrol prices tonight. Ha-ha.

4. The US rate hike story continue again ...this time need to watch the Dec 16-17 Fed meeting. Still a month and half away. There is a 50/50 chance Fed will increase the rate to 0.25%. It means the USD will be strong and RM will remain weak, for now.

5. XOX must be the hottest stock of the month of October. It keep going up despite 2 UMA from KLSE in a month! It look like a strong stock pump and dump to me. Some, not all, criteria, for a pump and dump are there.

GA

Thursday, October 29, 2015

Market Outlook as at October 29, 2015

FBMKLCI has once again dropped below the neckline of the head and shoulders top at 1680. On October 7, we had noted that the index managed to climb back above the neckline (for the chart, go here). That earlier recovery (above the neckline) meant that the prior interpretation of a market that had made a top was in doubt. However, with the index once again trading below the neckline, the interpretation that the market has made a top reassert itself.

Chart 1: FBMKLCI's weekly chart as at October 29, 2015_9.50am (Source: ShareInvestor.com)

For long-term charts on FBMKLCI & FBMEmas, look at Chart 2 & 3.

For long-term charts on FBMKLCI & FBMEmas, look at Chart 2 & 3.

Chart 2: FBMKLCI's monthly chart as at October 29, 2015_9.50am (Source: ShareInvestor.com)

Chart 3: FBMEmas's monthly chart as at October 29, 2015_9.50am (Source: ShareInvestor.com)

If the two indices do not recover above their respective neckline in the next 1-2 day(s), the negative interpretation would return, i.e. the market has made a top and will likely to continue to drift lower in the weeks and months ahead. Thus, it is important that we watch the market closely and take the necessary corrective action to adjust for the latest market outlook.

If the two indices do not recover above their respective neckline in the next 1-2 day(s), the negative interpretation would return, i.e. the market has made a top and will likely to continue to drift lower in the weeks and months ahead. Thus, it is important that we watch the market closely and take the necessary corrective action to adjust for the latest market outlook.

Saturday, October 24, 2015

Investing and Profiting from Calamities and Disasters in Malaysia

Every country on the planet have their own unique disasters and calamities. Some countries have more disasters while others less.

In Malaysia the usual natural calamities we have are the floods, storms, landslides and drought while the man-made calamity is the haze from Indonesia.

In the past the disasters which occurred were the bird flu virus, avian flu virus, and a tsunami in 2004. New disasters will crop up and this happened on June 5th, 2015 where we had our first 6.0 magnitude earthquake which struck Ranau, Sabah.

New potential calamities in the future could be the eruption of a big volcano in Indonesia or Philippines, a new disease, or a man-made calamity such as a terrorist attack on a city.

How to Make Money In the Stock Market From Natural and Man-Made Disasters in Malaysia.

1. Haze

This is happening right now so I picked this out first.

At first glance, the haze or smog from Indonesian forest fires seems a big disaster to the stock market.

People getting sick, airports closed, ships cannot sail, fewer tourists, events cancelled ..etc. So less profits for companies in travel and tourism.

But there is a silver lining to the haze..

Chickens dying, chicken laying fewer eggs, vegetables dying, fishermen staying home, oil palm trees producing less fruits, rubber trees producing less latex, ...all leading to less supply and higher prices.

Read this article about how "Haze choking farms too" and you know what I mean above.

So chicken and egg counters like Lay Hong, LTKM, Teo Seng Capital, and CPO prices go up and you will see what I call a Haze Rally.

|

| Example @LTKM Share price rally |

2. Diseases

Diseases such as bird flu, SARS, H1N1, H1N7, etc. appeared in early 2000's and have made comebacks on numerous occasions since.

If the disease becomes a world-wide or region-wide phenomenon affecting MALAYSIA too then we can expect the local companies producing medical rubber gloves to encounter a big and strong rally.

Other companies that also see a rally could be pharmacy counters and those producing drugs and vitamins.

However, expect the opposite effect on chicken and egg companies this time if the disease affect poultry because consumers will avoid eating them.

3. Drought (El Nino?)

The meaning of drought is a period of hot weather with very low rainfall.

In this case, if VERY BAD ...can expect cold and ice drinks producer and supplier like F&N and mineral water companies like Spritzer to make lots of money.

And extreme weather too could cause CPO prices to rally, you can go read article on "El Nino dry weather to lead to rise in the palm oil price"

4. Earthquakes and Tsunami

I grouped them together because earthquakes and tsunami are related.

We got struck by a tsunami in 2004 due to an undersea earthquake in Indonesia and a 6.0 magnitude earthquake happened in Sabah this year.

Not much of an impact because the area affected is usually very focused (small area) and remote unless the earthquake and tsunami struck on a big city causing major damages to properties and infrastructures.

Then construction companies will get big contracts in re-building buildings, homes, roads, bridges, etc.

5. Floods, Storms and Landslides

I also put them together because floods, storms and landslides are related.

Again, I see not much of an impact unless the disaster happen on a large scale causing a big portion of infrastructures to be destroyed or damaged.

Then construction companies will get big contracts in re-building buildings, homes, roads, bridges, etc.

6. Big Volcano Eruption

This will happen one day as Malaysia is in the area known as the "Ring of Fire" and Indonesia and Philippines are two countries with the largest active volcanoes in the world.

|

| Anak Krakatoa blowing ashes in 2011 |

Indonesian and Philippine volcanoes generally do not appear to be a threat due to the small size of the volcanoes and the distance of the volcanoes to Malaysia. However one WILD CARD could be a big volcano named "Anak Krakatoa" in Indonesia, (the site of the Krakatoa volcano eruption in 1883 which engulfed the whole region back then) ... this day this volcano is very active and often seen coughing out smoke, ash and lava.

The dangers with volcanoes isn't the eruptions but the smoke and ash that the strong wind could carry and blow around the region. It's similar to haze but FAR MORE DEADLY because volcanic smoke and ash contains dangerous chemicals and glass particles that can damage the lungs in a short time.

Same like haze ...people getting sick, airports closed, ships cannot sail, fewer tourists, events cancelled ..etc. so less profits for these companies.

But unlike the haze, there is NO silver lining to the volcanic ashes I think ..

Because with chickens dying, vegetables dying, oil palm trees dying, rubber trees dying, ...lead to less supply and higher prices.

But where to find supply if all are dead or dying?

I hope this volcano thing will not happen.

7.Terror Attack

Terrorists have always been in the news since the 2001 Twin Towers attack and lately since ISIS appeared. Quite possible it might happen in Malaysia one day.

IF this happens expect the whole stock market to crash for a day or more. But this is temporary like in the 2001 America attack. Many cheap sales so good time for bottom fishing.

Conclusion

Some people call this disaster investing or disaster trading. I did not cover wars and nuclear missiles as I think this is very remote. It can be very profitable if you bought at the beginning of the disaster and when prices is at close to the bottom. However dunno if it's good karma or not to do this since you are essentially trying to make money from other people's losses.

Thursday, October 22, 2015

The Problem With Oil Prices Is That They Are Not Low Enough

The problem with oil prices is that they are not low enough.

Current oil prices are simply not low enough to stop over-production. Unless external investment capital is curtailed and producers learn to live within cash flow, a production surplus and low oil prices will persist for years.

Energy Is The Economy

GDP (gross domestic product) correlates empirically with oil prices (Figure 1). GDP increases when oil prices are low or falling; GDP is flat when oil prices are high or rising (GDP and oil price in the figure are in August 2015 dollars).

Figure 1. U.S. GDP and WTI oil price. GDP and WTI are in August 2015 dollars. Note: I use WTI prices because Brent pricing did not exist before the 1970s.

Source: U.S. Bureau of Labor Statistics, The World Bank, EIA and Labyrinth Consulting Services, Inc.

This is because global economic output is highly sensitive to the cost and availability of energy resources (it is also sensitive to debt). Liquid fuels-gasoline, diesel and jet fuel-power most worldwide transport of materials, and electricity from coal and natural gas powers most manufacturing. When energy prices are high, profit margins are lower and economic output and growth slows, and vice versa.

Because oil prices were high in the 4 years before September 2014 and the subsequent oil-price collapse, GDP was flat and economic growth was slow. That, along with high government, corporate and household debt loads, is the main reason why the post-2008 recession has been so persistent and difficult to correct through monetary policy.

Why Oil Prices Were High 2010-2014 and Why They Are Low Today

Brent oil prices exceeded $90 per barrel (August 2015 dollars) for 46 months from November 2010 until September 2014 (Figure 2). This was the longest period of high oil prices in history. Prolonged high prices made tight oil, ultra-deep water oil and oil-sand development feasible. Over-investment and subsequent over-production of expensive oil contributed to the global liquids surplus that caused oil prices to collapse beginning in September 2014.

Current oil prices are simply not low enough to stop over-production. Unless external investment capital is curtailed and producers learn to live within cash flow, a production surplus and low oil prices will persist for years.

Energy Is The Economy

GDP (gross domestic product) correlates empirically with oil prices (Figure 1). GDP increases when oil prices are low or falling; GDP is flat when oil prices are high or rising (GDP and oil price in the figure are in August 2015 dollars).

Figure 1. U.S. GDP and WTI oil price. GDP and WTI are in August 2015 dollars. Note: I use WTI prices because Brent pricing did not exist before the 1970s.

Source: U.S. Bureau of Labor Statistics, The World Bank, EIA and Labyrinth Consulting Services, Inc.

This is because global economic output is highly sensitive to the cost and availability of energy resources (it is also sensitive to debt). Liquid fuels-gasoline, diesel and jet fuel-power most worldwide transport of materials, and electricity from coal and natural gas powers most manufacturing. When energy prices are high, profit margins are lower and economic output and growth slows, and vice versa.

Because oil prices were high in the 4 years before September 2014 and the subsequent oil-price collapse, GDP was flat and economic growth was slow. That, along with high government, corporate and household debt loads, is the main reason why the post-2008 recession has been so persistent and difficult to correct through monetary policy.

Why Oil Prices Were High 2010-2014 and Why They Are Low Today

Brent oil prices exceeded $90 per barrel (August 2015 dollars) for 46 months from November 2010 until September 2014 (Figure 2). This was the longest period of high oil prices in history. Prolonged high prices made tight oil, ultra-deep water oil and oil-sand development feasible. Over-investment and subsequent over-production of expensive oil contributed to the global liquids surplus that caused oil prices to collapse beginning in September 2014.

Figure 2. Brent price in 2015 dollars and world liquids production deficit or surplus.

Source: EIA, U.S., U.S. Bureau of Labor Statistics and Labyrinth Consulting Services, Inc.

Oil prices were high during during the 4 years before prices collapsed because world liquids production deficits dominated the oil markets. This was due mostly to ongoing politically-driven supply interruptions in Libya, Iran, and Sudan beginning in 2011. The easing of tensions particularly in Libya after 2013 along with increasing volumes of tight and other expensive oil led to a production surplus by early 2014 (Figure 3). Before January 2014, supply was less than consumption but afterward, supply was greater than consumption.

Figure 3. World liquids supply and consumption, and Brent crude oil price.

Source: EIA and Labyrinth Consulting Services, Inc.

The global production surplus has persisted for 21 months and supply is still 1.2 million barrels per day more than consumption. This is the main cause of low oil prices that began in mid-2014.

Why Over-Production Continues

Actions taken by the U.S. Federal Reserve Bank to stimulate the economy after the Financial Crisis in 2008 were partly responsible for high oil prices and for the over-production of tight oil in the U.S. that eventually caused oil prices to collapse in 2014.

The U.S. central bank lowered the Federal Funds Rate-the interest that it charges for loans to commercial banks-from approximately 5.5% before the 2008 collapse to 0.2% in late 2008 (Figure 4). By mid-2014, the rate had dropped below 0.1%.

Figure 4. U.S. Federal Funds interest rates, M1 money supply and CPI-adjusted WTI crude oil prices.

Source: EIA, U.S. Bureau of Labor Statistics, U.S. Federal Reserve System and Labyrinth Consulting Services, Inc.

At the same time, the Federal Reserve Bank increased the U.S. money supply (Figure 4) from about $1.4 trillion before the 2008 collapse to more than $3 trillion today as part of a policy called Quantitative Easing (QE). QE involved creating money to buy U.S. Treasury bonds. This lowered the yield that these bonds paid and forced investors into riskier investments like the stock market and U.S. exploration and production (E&P) company bonds and secondary share offerings.

There is a negative correlation between the value of the U.S. dollar relative to other currencies and oil prices (Figure 5). When the U.S. dollar is strong, oil prices generally fall and vice versa chiefly because worldwide oil commodity trades are denominated in dollars.

Figure 5. U.S. trade-weighted dollar value and CPI-adjusted Brent crude oil prices.

Source: EIA, U.S. Bureau of Labor Statistics, U.S. Federal Reserve System and Labyrinth Consulting Services, Inc.

Quantitative Easing, the increase in the U.S. money supply and artificially low interest rates resulted in a weaker U.S. dollar that was a contributing factor to higher oil prices after 2008 (an OPEC production cut in early 2009 was another important factor). The end of QE in mid-2014 and a resulting stronger U.S. dollar corresponded with the collapse in world oil prices (Figure 5).

The relationship between interest rates, money supply, the strength of the dollar and oil prices is complicated and I do not mean to over-simplify its complexity. The observed patterns are, nevertheless, interesting and useful for understanding the broad trends of the last several years at least on a high level.

The net effect of all of these monetary policies was to undermine conventional, passive investments-savings accounts, CDs, U.S. Treasury bonds, etc.-because of low yields (1- 2.5%). Investors were driven to the U.S. E&P sector where high-yield ('junk') bonds and secondary share offerings provide yields of 6-10%. These investments are based on a coupon payment or dividend and not on the company's success unless, of course, the company goes bankrupt.

This and other risks are rationalized by the fact that the investments are in the fiscally 'safe' United States, are backed by a hard asset-oil and gas-in the ground, and that even if a company becomes distressed, it will likely be bought and the investment preserved.

More than $61 billion has flowed to North American E&P companies so far in 2015 both as equity and debt (Figure 6). This is more than in any previous year despite low oil prices, plunging stock prices and poor financial performance for most E&P companies.

Figure 6. Private equity capital directed to North American energy companies.

Source: Wall Street Journal (September 3, 2015) and Bloomberg Businessweek (October 15, 2015).

The only expectation from the financial markets is apparently that production and reserves grow or are at least maintained.

A weak global economy, the monetary policies that were used to strengthen it, and world geopolitical events combined to produce a surge in expensive oil production that was made possible by high oil prices and almost infinite access to capital by producers.

Now that oil prices have fallen by half, many expected that production would fall sharply.

That has not happened because capital supply has not fallen with lower prices but has increased. To be sure, U.S. production has declined and will decrease further. EIA's forecast (Figure 7) suggests that it will fall approximately 940,000 bopd from its peak in April 2015.

.jpg)

Figure 7. EIA crude oil production and forecast.

Source: EIA and Labyrinth Consulting Services, Inc.

The U.S., however, is not the world and less than a million barrels per day of lower U.S. oil production will not make much of a difference in the global surplus. Although world production has declined somewhat, it is still 850,000 bpd higher than its 2014 peak and a supply surplus persists (Figure 8).

Figure 8. World liquids production, consumption and production surplus or deficit.

Source: EIA and Labyrinth Consulting Services, Inc.

Global producers are similar to their U.S. counterparts. Most of them must also satisfy investor expectations, have considerable access to capital, must maintain cash flow, even at a loss, to service debt, and have benefited from greatly reduced oil field service costs that accompany lower oil prices.

The Problem With Oil Prices Is That They Are Not Low Enough

Brent international oil prices have averaged more than $55 per barrel ($51 for WTI) in 2015. As long as prices remain in that range, I doubt that production will fall enough to balance the market for several years or more barring a surge in demand or renewed supply interruptions.

Figure 9 shows that the long-term average oil price (1950-2015) is $45 per barrel in August 2015 dollars.

Figure 9. WTI oil prices in August 2015 dollars, January 1950 - August 2015.

Source: EIA, U.S. Bureau of Labor Statistics and Labyrinth Consulting Services, Inc.

Before the Arab Oil Embargo (1973-74) and the beginning of the Iran-Iraq War (1980), the average price was $23 per barrel. In the 1986 to 2003 period after these oil shocks and before the Financial Collapse, prices averaged $34 per barrel.

These prices seem quite low from our sticker-shocked perspective of the early 21st century, yet oil companies made profits when prices were $15 to $25 real dollars per barrel less than they are today. More importantly, those periods of low oil prices were also times of economic growth and prosperity (Figure 1), whereas the intervening periods of higher oil prices were times of low economic growth.

Capital will continue to flow to E&P companies as long as high yields on bonds and secondary share offerings are paid. Sustained oil prices in the $30-40 range would create sufficient distress among high-cost zombie producers to cause defaults on those offerings. This alone will stop the capital enablers-the investment banks-from directing funds to the E&P sector.

Many believe that the upcoming credit re-determinations and year-end reserve write-downs will greatly limit available capital, and that this will lead to oil market balance. I hope that they are right. I suspect, however, that the capital enablers will stay the course despite higher risks simply because they are unable to identify alternative investments that offer a comparable yield.

Some like OPEC and Wood Mackenzie believe that demand growth will balance the oil market. I also hope that they are right. Others, however, like the IEA take a more pessimistic view because of a weak global economy. The IEA's view of the economy seems sound to me and I am, therefore, doubtful that demand growth will balance the market.

Still others are hopeful that OPEC will cut production and that will balance the market. I don't believe that will happen. A production cut would accomplish little except perhaps for a short-term increase in prices that would result in higher cash flows and a rebound in drilling activity-in short, it would compound the problem of over-supply.

The only way to achieve oil market balance is for prices to go low enough for long enough to stop the flow of external capital to the producers and to force them to live within cash flow. The intriguing aspect of this proposition is the possibility of a return to economic growth that has so far eluded the best efforts of central bankers and economists.

Source: http://www.oilvoice.com/n/The-Problem-With-Oil-Prices-Is-That-They-Are-Not-Low-Enough/a42a7c59c41d.aspx

Monday, October 19, 2015

LCTH - Cup and Handle Pattern

LCTH on cup and handle pattern, this morning at 10.45 am just broken out of the 70c resistance ...looking at the pattern ... LCTH "might" go 80c ++ if market is still ok. Trade at own risk.

Sunday, October 18, 2015

ValueCap Share Buy ‘Spree’ Starts November

Wan Kamaruzaman says the funds will be released in tranches to ensure good timing and investment climate. (Pic by Muhd Amin Naharul/TMR)

Wan Kamaruzaman says the funds will be released in tranches to ensure good timing and investment climate. (Pic by Muhd Amin Naharul/TMR)

State-owned investor ValueCap Sdn Bhd is expected to start a mopping up spree of underperforming stocks on Bursa Malaysia from November, when its shareholders release the first tranche of its announced RM20 billion fund.

ValueCap’s three shareholders — Khazanah Nasional Bhd, Retirement Fund Inc (KWAP) and Permodalan Nasional Bhd (PNB) — are expected to make available RM8 billion as part of the initiative to strengthen the economy that was announced by the prime minister last month.

KWAP CEO Wan Kamaruzaman Wan Ahmad said the three shareholders will each provide an equal RM6.67 billion to ValueCap’s kitty.

“We were given an aggressive deadline of Oct 15 (to start), but we think it will be difficult due to regulatory steps and approvals as well as the nod from each shareholder’s board.

“We estimate ValueCap to commence with funds available somewhere in the second-half of November,” he told The Malaysian Reserve at the sidelines of the Khazanah Megatrends Forum 2015 yesterday.

He said all three shareholders have finalised respective funding structures and are awaiting to present the plan to their board.

Wan Kamaruzaman said the shareholders, all state-owned investment companies, may go to the bond or debt markets to raise their share of ValueCap’s fund but KWAP will likely use internal funds.

“KWAP will not go to the market. We will utilise our cash balance to fund ValueCap. KWAP usually keeps 5% or RM5 billion in cash.”

Wan Kamaruzaman said the funds will be released in tranches to ensure good timing and investment climate.

“We start with up to 40% in [the] first release. ValueCap can only request for additional drawdown from the shareholders when the time is right,” he said.

He also said that the funding will be released by all three shareholders simultaneously.

ValueCap — which was reactivated last month — was set up to invest prudently and to create value by propping up undervalued stocks in Bursa Malaysia.

During ValueCap’s previous stint from 2002 to 2013, the firm was able to generate an annual average return of 15% and accumulate RM8 billion in profits, higher than the Kuala Lumpur Composite Index’s return of 10% over the same period.

Source:http://themalaysianreserve.com/new/story/valuecap-share-buy-%E2%80%98spree%E2%80%99-starts-november

Saturday, October 17, 2015

Financial Markets Calm Before the Storm?

BIG PICTURE - Global business activity is slowing down and the majority of the developing nations are experiencing severe economic problems. Over in the developed world, Japan is contracting again, Euro zone is barely growing and even America's leading economic indicators are suggesting trouble ahead. Elsewhere, the CRB Index is trading at a 13-year low and this implosion in the prices of commodities is suggesting that all is not well with the global economy.

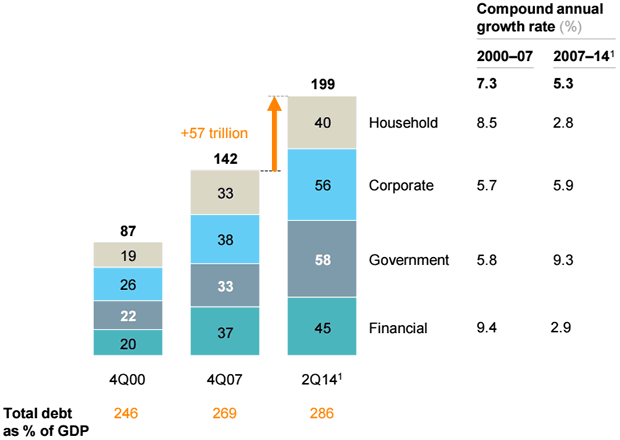

The crux of the matter is that the world is severely over-indebted (debt to GDP ratio of 286%, Figure 1) and without fiscal measures, viable reforms and debt restructuring, we will probably remain stuck in this low growth environment for years. Unfortunately, you cannot solve a problem of too much debt by encouraging even more borrowing; yet policymakers are trying to fix this mess by lowering interest rates and injecting liquidity.

Figure 1: Global stock of debt outstanding (US$ trillion)

Source: McKinsey & Company

Make no mistake, the US housing boom and subsequent financial crisis of 2008 were caused by the Federal Reserve's easy monetary policies which were put in place after the TMT bust. By dropping rates to emergency levels and keeping them there for years, Mr. Greenspan spawned the US housing bubble which almost destroyed the world's banking system. So, by keeping its Fed Funds Rate at zero since late 2008, it is ironic that the Federal Reserve is (once again) walking down the same path!

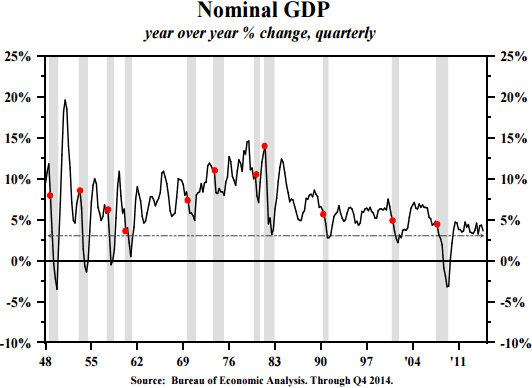

It is notable that even though the Federal Reserve's monetary policy has been extremely accommodative since the global financial crisis; the recovery in the US has been sub-par when compared to the previous economic cycles (Figure 2).

This is due to the fact that despite the carrot of record-low borrowing costs dangling in front of them, American households have refused to take the bait. Instead, they have done the sensible thing and deleveraged their balance-sheets.

Figure 2: US nominal GDP (1948-2014)

Source: Hoisington

Today, the household debt to GDP ratio in the US is 80%, well below the 100% level reached in 2008. This meaningful decline demonstrates that the Federal Reserve's ultra-accommodative monetary policies have done very little in terms of boosting household borrowing and consumption.

Instead, by dropping short-term rates to zero and keeping them there for 7 years, this time around, the Federal Reserve has succeeded in spawning new bubbles in the corporate sector, which pose a serious threat to the economy. Presented below is a list of the obvious corporate bubbles:

US Corporate debt - US$5trillion (+ US$2 trillion since 2007)

High yield (junk) bonds and leveraged loans - US$2.2 trillion (+ US$1.2 trillion since 2007)

Biotechnology - 7-fold increase in NASDAQ Biotech Index; most companies have no earnings

In addition to the above excesses in the corporate world, the Federal Reserve's zero interest rate policy (ZIRP) has also blown the following domestic bubbles:

Student loans - US$1.2 trillion (+ US$0.7 trillion since 2007)

Auto loans - US$1 trillion (+ US$0.4 trillion since 2009)

Last but not least, the Federal Reserve's monetary policy has also inflated these international bubbles:

Commodities boom and subsequent bust

Commodities exporters' boom and bust (Australia, Brazil, Canada and Russia)

Singapore property

Stock markets of Indonesia, Philippines and Thailand

Hong Kong property - HK$1.044 trillion mortgage debt (+ 76% since 2009)

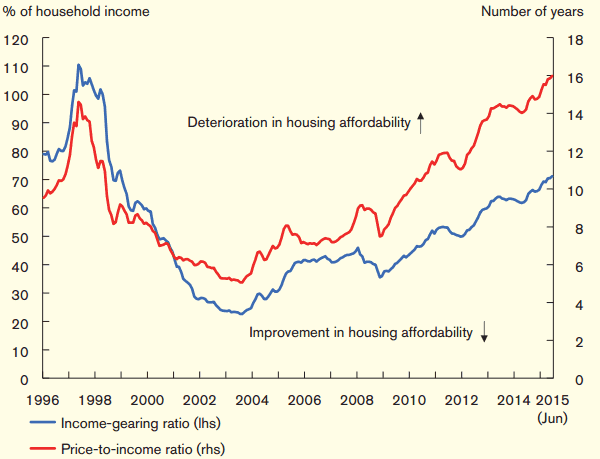

In terms of the Hong Kong property market, although most experts and talking heads on TV remain convinced there is nobubble, research from the Hong Kong Monetary Authority (HKMA) shows that housing has become extremely unaffordable. If you review Figure 3, you will note that the housing price-to-income ratio has now risen to a record high of 15.9 and it is even higher than the 1997 peak of 14.6. Meanwhile, the income-gearing ratio has increased further to 70.7%, well above the long-term average of 50%. According to the HKMA, if the mortgage interest rate returned to a more normal level, say an increase of 300-basis points, the income-gearing ratio would soar to 95%!

Figure 3: Indicators of Hong Kong housing affordability

Source: Hong Kong Monetary Authority

Today, many Wall Street firms, prominent hedge fund managers and academics are putting forward arguments as to why the Federal Reserve should not raise the Fed Funds Rate. In their eyes, the macro-economic conditions are too uncertain to even warrant a 25bps rate hike.

In our view, these folk are dead wrong because unlike Europe and Japan, the US economy does not need ZIRP. If our assessment is correct, the longer the Federal Reserve stays on hold, the bigger will be the eventual bust.

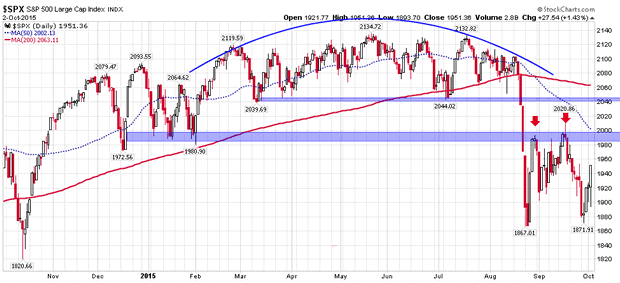

Turning to the stock market, it is our contention that the bull market on Wall Street ended in May and we are now in the early stages of primary downtrend. You will recall that the US stock market fell sharply in mid-August and since then, it has gyrated within a wide trading range. To the casual observer, these wild swings may not make much sense but closer inspection reveals that there is indeed a method to the stock market's madness.

If you review Figure 4, you will note that between late February and early August, the S&P500 Index carved out an enormous rounding top formation; which culminated in the plunge below the key support levels (shaded areas on the chart). Thereafter, in late August, the relief rally faded around the lower support (now resistance) level. The S&P500 Index then spent two weeks in a sideways grind and the next rally attempt also ended at the same overhead resistance. Following this failed rally attempt, the S&P500 Index re-tested its August low and over the past few trading sessions, it has put together another advance.

Figure 4: S&P500 Index (daily chart)

Source: www.stockcharts.com

At this stage, nobody knows when this bounce will end but if we are in a primary downtrend, the rally should fade around overhead resistance level (2000-2040). Under this scenario, the next leg down will probably take out the August-low and trigger a waterfall decline. Currently, we cannot guarantee how low the S&P500 Index might fall; but we see support in the 1,700-1,740 area. So, if our bear market hypothesis is correct, then the ongoing rally will end soon and give way to the next wave of selling.

Look. There are no certainties when dealing with the future, but our work leads us to believe that the bull market is now in the rear view mirror and the odds of new highs over the following months are slim to none. Our bearish prognosis stems from the following data points:

S&P500 Index is below the 50-day and 200-day moving averages which are pointing down

NYSE Advance/Decline Line peaked in April (prior to the stock market peak in May + July)

Our proprietary trend following filter is now flashing 'downtrend'

NYSE Bullish Percent Index has dropped to just 31%

The High yield (junk) bond ETF has taken out the August-low

Only 22% of the NYSE stocks are trading above the 200-day moving average

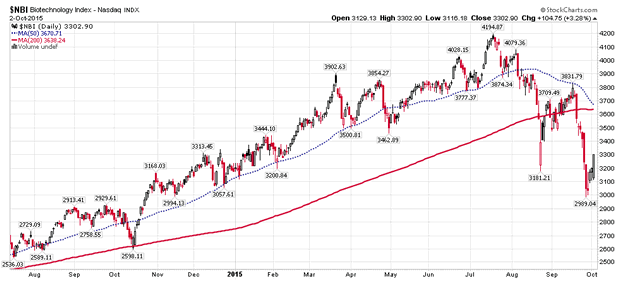

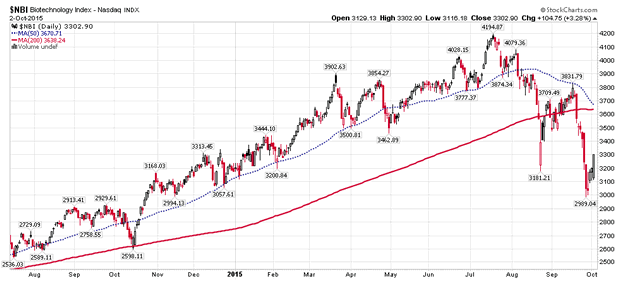

Biotechnology - The leading sector of the bull-market has topped out (Figure 5)

Russell 2000 Small Cap Index and Russell 2000 Growth Index have taken out the August low

Out of the 35 industries we monitor, just 6 are trading above the 200-day moving average

Leading stocks are declining on good 'news', indicating the best has been discounted

Stocks are declining despite ongoing QE in Europe and Japan

Stocks are declining despite no rate hike and a 'dovish' Federal Reserve

Volume is rising on down days and falling on up days

Bearing in mind the above price and volume data, we are almost certain that the primary trend for equities is now down and global stock markets remain vulnerable to heavy declines.

Figure 5: NASDAQ - Biotechnology Index

Source: www.stockcharts.com

Given the weak technical picture and worsening economic backdrop, we currently have no exposure to risky assets (commodities, high yield debt and stocks). Instead, we have invested our managed capital in the following manner:

Long dated US Treasuries & Zero Coupon Bonds - 40% allocation

Short-term US Treasuries - 35% allocation

Short positions (biotechnology, industrials and technology) - 15% allocation

'Long' US Dollar position - 5% allocation

US Dollar cash - 5% allocation

If our analysis of the situation is even vaguely correct, our managed portfolios will do well in the looming deflation and our strategy should outperform our benchmark (MSCI AC World Index) by a wide margin. Conversely, if stocks continue to rally (unlikely scenario) and our primary trend filter flips to 'uptrend', we will promptly re-position our managed accounts.

Puru Saxena is the CEO of Puru Saxena Wealth Management, his Hong Kong based SFC regulated firm which offers discretionary portfolio management and research services to individual and corporate clients. The firm manages two trend-following strategies – Discretionary Equity Portfolio and Discretionary Fund portfolio. In addition, the firm also manages a Discretionary Blue-chip Portfolio which invests in high-dividend world leading companies. Performance data of these strategies is available from www.purusaxena.com

Puru Saxena also publishes Money Matters, a monthly economic report, which identifies trends and highlights investment opportunities in all major markets. In addition to the monthly report, subscribers of Money Matters also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2015 Puru Saxena Limited. All rights reserved.

NYSE Advance/Decline Line peaked in April (prior to the stock market peak in May + July)

Our proprietary trend following filter is now flashing 'downtrend'

NYSE Bullish Percent Index has dropped to just 31%

The High yield (junk) bond ETF has taken out the August-low

Only 22% of the NYSE stocks are trading above the 200-day moving average

Biotechnology - The leading sector of the bull-market has topped out (Figure 5)

Russell 2000 Small Cap Index and Russell 2000 Growth Index have taken out the August low

Out of the 35 industries we monitor, just 6 are trading above the 200-day moving average

Leading stocks are declining on good 'news', indicating the best has been discounted

Stocks are declining despite ongoing QE in Europe and Japan

Stocks are declining despite no rate hike and a 'dovish' Federal Reserve

Volume is rising on down days and falling on up days

Bearing in mind the above price and volume data, we are almost certain that the primary trend for equities is now down and global stock markets remain vulnerable to heavy declines.

Figure 5: NASDAQ - Biotechnology Index

Source: www.stockcharts.com

Given the weak technical picture and worsening economic backdrop, we currently have no exposure to risky assets (commodities, high yield debt and stocks). Instead, we have invested our managed capital in the following manner:

Long dated US Treasuries & Zero Coupon Bonds - 40% allocation

Short-term US Treasuries - 35% allocation

Short positions (biotechnology, industrials and technology) - 15% allocation

'Long' US Dollar position - 5% allocation

US Dollar cash - 5% allocation

If our analysis of the situation is even vaguely correct, our managed portfolios will do well in the looming deflation and our strategy should outperform our benchmark (MSCI AC World Index) by a wide margin. Conversely, if stocks continue to rally (unlikely scenario) and our primary trend filter flips to 'uptrend', we will promptly re-position our managed accounts.

Puru Saxena is the CEO of Puru Saxena Wealth Management, his Hong Kong based SFC regulated firm which offers discretionary portfolio management and research services to individual and corporate clients. The firm manages two trend-following strategies – Discretionary Equity Portfolio and Discretionary Fund portfolio. In addition, the firm also manages a Discretionary Blue-chip Portfolio which invests in high-dividend world leading companies. Performance data of these strategies is available from www.purusaxena.com

Puru Saxena also publishes Money Matters, a monthly economic report, which identifies trends and highlights investment opportunities in all major markets. In addition to the monthly report, subscribers of Money Matters also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2015 Puru Saxena Limited. All rights reserved.

Subscribe to:

Posts (Atom)