Bookmark this blog/link and re-visit often for ideas/opinions/views on making $money$, from the Stock market, Forex, Commodities, Internet Business, etc.

Showing posts with label Stock Investing. Show all posts

Showing posts with label Stock Investing. Show all posts

Friday, December 23, 2016

Thursday, June 16, 2016

Why I have decided to stop Investing in the Stock Market

Yes, I have decided to stop investing in the stock market.

Whatever shares I hold now I will keep them for their dividends or for those shares I bought for trading when they reach my target price I will dispose them and keep the cash.

I will NOT be adding in more money into the stock market.

REASONS are as follows :

1) I am already Invested In Stock Market via my EPF savings - If you worked before, you would have some money in EPF Account 1 and 2. The money inside is invested by EPF in various asset class, the stock market being one of them - EPF has 44% of the funds invested in the stock market as at 2015 (see diagram below)

IMO 44% is a large amount so I am thinking why I am putting in SOME MORE risk money into the stock market. Our EPF is already doing it for me, whether I want it or not (*grin)

2) The stock market is always dangerous minefield. One or two wrong steps you go KABOOM even if you are a professional or old timer. Since I am an entrepreneur (not a salaried worker) I am entitled to contribute money each month into EPF. I will put money into EPF from now on as EPF guaranteed a minimum of 2.5% dividend annually to the members. It would be foolish NOT to do this since I will never lose my principal sum yet earn a minimum 2.5% yearly. I will let EPF do all the hard work of investing and trading for me from now on (*grin).

3) The stock market is in BEAR MARKET. I categorize bear market as when the KLCI Index is below the 200 day MA. Apart from KLCI Index, many stocks are also trading below the 200 MA. Those that do not read widely or is an old timer do not realize that during any bear markets the market is excessively volatile. And the syndicates are hungrier than usual (*grin). I can tell from experience I will NOT make any money in a bear market in the long run. I will make some money only to lose it back later. So it's better to stay away.

4) It's time to go into another passion of mine - Internet Business! I believe I can be successful there. I have been doing it on and off for 5 years but the stock market always distract me (*grin).

5) Lastly, I am getting older by the day. Time to get out of big risk, do less stressful things, be lazy as I want, enjoy life and get ready for retirement (*grin).

All the best to those still investing and trading! I will still post regularly on this blog - Ongmali because I love it dearly.

Yours truly,

Ongmali

Wednesday, April 20, 2016

WHAT A DIFFERENCE A COUPLE OF MONTHS MAKES

My what a difference a couple of months makes. Several months ago everyone was convinced that stocks were starting a protracted bear market. Many expected it to be even worse than the last one in 2008/09.

A couple of months ago everyone was calling for 110-120 on the dollar index.

A couple of months ago everyone knew that oil was going to the low 20’s or even into the teens.

And several months ago everyone was convinced that gold would trade below $1000 some even calling for targets below $800.

I disagreed with every one of these assumptions. Why? Because all markets were due for multi-year cycle lows. (Except the dollar which was due for a multi-year cycle top).

As we now know all of these assumptions were 180 degrees wrong.

Folks when everyone is thinking the same thing, then no one is thinking.

Now we have many people swinging for the fences in the opposite direction. That’s what a persistent trend will do to trader bias.

Here’s my contrary predictions for the next several months.

Almost everyone is still assuming that stocks are in a bear market and that we are just forming a double top. Stocks are not forming a double top. This is a new 7 year cycle. There is simpoly no way a new 7 year cycle can top in less than 2 1/2 years. Stocks are going to go so far above the all time highs in the next several years that it will make your head swim.

The current theory is the dollar is now ready to crash. Again the crowd is on the wrong side of the boat. The dollar is not going to crash. In fact it’s due for a multi-week rally. But once the rally has run its course the dollar will continue down and the 7 year bull market is over.

Everyone continues to get sidetracked by the supposed fundamentals in oil. This is not a bear market rally in oil. The fundamentals have already changed even though no one can see it yet. We are never going to see $26 oil again.

And the strength of the rally in gold has convinced many that this time is different. Too many analysts are now expecting only a sideways correction in gold or a very mild intermediate degree correction. This is absurd. The dollar hasn’t even rallied yet. How in the world can one predict that gold will just trade sideways before the dollar even delivers its rally? Gold is going to correct and the move down into the intermediate cycle low will be much more severe than anyone is currently expecting. Miners will retrace at least 50% of the baby bull rally and in the process completely cleanse the bullish sentiment that has built up in the sector.

Once the correction has knocked everyone off the bull and convinced most everyone that the bear has returned, then and only then will gold be ready for the next leg up in its new bull market.

Thursday, March 24, 2016

Three Reasons to Be Bearish Right Now

The stock market looks dangerous.

By Jeff Clark, Growth Stock Wire:

There are so many reasons to be bearish right now, I can’t count all of them. Dozens of indicators are flashing “warning” signs. The market looks dangerous. Almost everything is pointing toward an intermediate-term decline coming soon.

And if it plays out the way it did when we had the same setup in November, stocks may give up all of the gains they’ve enjoyed over the past few weeks. So you need to be cautious right now. Here are three reasons why…

One, the S&P 500 is tracing out an identical pattern to what it did last October — just before the S&P 500 fell 5% in two weeks and 18% in three months. Take a look at the one-year chart of the S&P 500…

This entire bounce off the February lows has the exact same characteristics as the October rally. Both started from deeply oversold levels, following a sharp selloff in the stock market. They both formed dangerous “rising-wedge” patterns on the chart. And both pushed the daily momentum indicators – like the moving average convergence divergence (MACD), the relative strength index (RSI), and the full stochastics – into extreme overbought territory.

If the similarities continue, then then the stock market is likely headed for a rough period – starting soon.

The second big reason to be bearish is that the Volatility Index (“VIX”) options are pricing in a sharply higher VIX over the next month.

The Volatility Index is a measurement of fear in the marketplace. When the VIX is high and rising, investors are scared and traders are bearish. A low and declining VIX indicates strong bullish sentiment and complacency among traders. But it’s the VIX option prices that can tell traders where the VIX is headed, and by extension, where the stock market is headed. And right now, VIX options are sending traders a bearish signal.

VIX options are European-style contracts – meaning they can only be exercised on option-expiration day. This eliminates any possible “arbitrage” effect (the act of buying an option, exercising it immediately, and then selling the underlying security for a profit). So VIX options will often trade at a discount to intrinsic value.

For example, the VIX closed around 13.80 on Monday. At that level, the VIX April $15 calls are intrinsically worth $1.20. But they were being offered for only $0.50. That’s a $0.70 discount to intrinsic value.

If it existed as a regular American-style stock option, you could buy the call, exercise it, and liquidate the position all day long, picking up $70 for every contract you traded. The European-style feature prevents that from happening – because you can only exercise this contract on April’s option-expiration day.

VIX options provide terrific clues about where most traders expect the Volatility Index to be when the options expire. The current VIX option prices tell us that traders expect the index to be higher one month from now.

With the VIX at 13.80, the VIX April $14 calls – which are $0.20 out of the money – closed Monday at $3.20. The VIX April $14 puts – which have $0.20 of intrinsic value – closed at $0.20.

In other words, traders are willing to pay 16 times more to bet that the VIX will be higher by option-expiration day in April. And a higher VIX usually coincides with a falling stock market. We had a similar situation, by the way, in late October. Back then, VIX call options were trading for about six times the price of the equivalent put options.

Finally, multiple technical indicators have reached extreme overbought levels.

For example, the percentage of S&P 500 stocks trading above their 50-day moving average (“DMA”) lines has hit its highest level in about six years.

A reading of more than 80% is considered extremely overbought. This indicator closed Monday at 93.4%. (Since it is a percentage, it is almost mathematically impossible for it to go much higher.) Notice also that the current reading is higher than the level it reached in early November – just before stocks started to sell off.

The Summation Indexes for the New York Stock Exchange (NYSE) and the Nasdaq – which also measure overbought and oversold conditions – are back up in “nosebleed” territory.

Both indexes closed Monday well above the overbought levels they reached last November. They’re even higher now than they were when the stock market peaked last May.

I could go on… I could show you how the McClellan Oscillators for both the NYSE and the Nasdaq recently hit overbought extremes. I could show you how the VIX is pressing down on its lower Bollinger Band – something that usually happens just before the stock market sells off. I could post a chart of the S&P 500’s “bullish percent index,” which is overbought and trading above its high from last May. You get my point.

As I said above, the market looks dangerous right now. All signs are pointing to an intermediate-term decline coming soon. And if it plays out the same way it did when we had an identical setup in November, stocks may give up all of their gains from the past few weeks. This is not a good time to be aggressively buying stocks. In fact, it’s probably a good time to speculate on the short side. By Jeff Clark, Growth Stock Wire

Wednesday, March 16, 2016

Unlocking The Game: How to know if your stock has potential to EXPLODE !! one day?

Life as an investor in the stock market has been tough in the last few months, with stocks falling or not moving most of the times. Although you are very optimistic about their turnaround potential and believe that your stocks will deliver strong total returns moving forward, you are sometimes baffled as to why your stocks are not going up when your gut feelings and instincts suggest otherwise.

If you are have this dilemma and thinking aloud whether to keep, buy more or sell off the stock you have, my short article below might be of help.

How to know if your stock has potential to EXPLODE one day?

There are many many reasons why a stock will RALLY going forward and I am quoting the reasons based on my own trades to illustrate the points.

1. The stock has a bullish chart pattern.

2. The financials of the stock improved from previous quarter by a large amount.

3. The stock is in a sector in play now.

4. The stock is a beneficiary of something eg . US$ increase, palm oil prices, tariff hikes, breakout of a disease etc.

5. The stock trading volumes are increasing.

6. The stock appear in a financial magazine or newspaper.

7. The stock appear in a blog or a forum and written by someone who can influence and push up the stock price.

8. The stock secured a big project.

9. The stock appear in a Facebook, WhatsApp or Telegram group as a tip.

10.The stock has a recent generous right issue with free warrants.

11. The stock has announce a bonus issue.

12. The stock is an election play.

13. The stock is increasing its dividends.

14. The stock has a low PE Ratio.

15. The stock proposed a generous special dividend.

16. The stock announced that a dynamic personality has bought a substantial stake in the company.

The 16 reasons I mentioned above are just the tip of the iceberg, there are many many other reasons a stock will rally ... but these are the major reasons I will look at to determine whether a stock has potential or not. So if you have a sleeping stock do not despair if you have a few things going on like the above. But a word of warning ... I am not God ...so be prepare to do your own due diligence when deciding to invest in a stock.

14. The stock has a low PE Ratio.

15. The stock proposed a generous special dividend.

16. The stock announced that a dynamic personality has bought a substantial stake in the company.

The 16 reasons I mentioned above are just the tip of the iceberg, there are many many other reasons a stock will rally ... but these are the major reasons I will look at to determine whether a stock has potential or not. So if you have a sleeping stock do not despair if you have a few things going on like the above. But a word of warning ... I am not God ...so be prepare to do your own due diligence when deciding to invest in a stock.

Thursday, October 29, 2015

Market Outlook as at October 29, 2015

FBMKLCI has once again dropped below the neckline of the head and shoulders top at 1680. On October 7, we had noted that the index managed to climb back above the neckline (for the chart, go here). That earlier recovery (above the neckline) meant that the prior interpretation of a market that had made a top was in doubt. However, with the index once again trading below the neckline, the interpretation that the market has made a top reassert itself.

Chart 1: FBMKLCI's weekly chart as at October 29, 2015_9.50am (Source: ShareInvestor.com)

For long-term charts on FBMKLCI & FBMEmas, look at Chart 2 & 3.

For long-term charts on FBMKLCI & FBMEmas, look at Chart 2 & 3.

Chart 2: FBMKLCI's monthly chart as at October 29, 2015_9.50am (Source: ShareInvestor.com)

Chart 3: FBMEmas's monthly chart as at October 29, 2015_9.50am (Source: ShareInvestor.com)

If the two indices do not recover above their respective neckline in the next 1-2 day(s), the negative interpretation would return, i.e. the market has made a top and will likely to continue to drift lower in the weeks and months ahead. Thus, it is important that we watch the market closely and take the necessary corrective action to adjust for the latest market outlook.

If the two indices do not recover above their respective neckline in the next 1-2 day(s), the negative interpretation would return, i.e. the market has made a top and will likely to continue to drift lower in the weeks and months ahead. Thus, it is important that we watch the market closely and take the necessary corrective action to adjust for the latest market outlook.

Saturday, October 17, 2015

Financial Markets Calm Before the Storm?

BIG PICTURE - Global business activity is slowing down and the majority of the developing nations are experiencing severe economic problems. Over in the developed world, Japan is contracting again, Euro zone is barely growing and even America's leading economic indicators are suggesting trouble ahead. Elsewhere, the CRB Index is trading at a 13-year low and this implosion in the prices of commodities is suggesting that all is not well with the global economy.

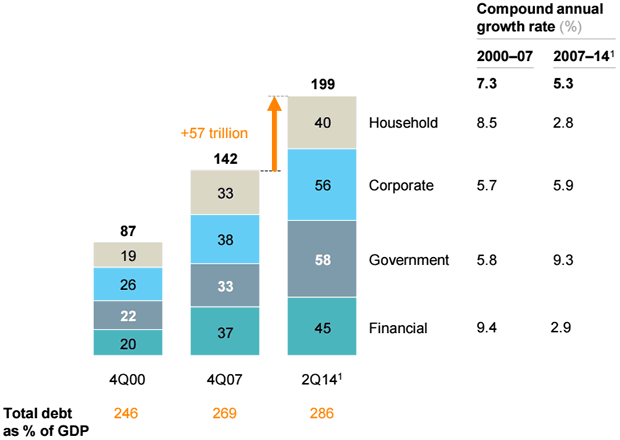

The crux of the matter is that the world is severely over-indebted (debt to GDP ratio of 286%, Figure 1) and without fiscal measures, viable reforms and debt restructuring, we will probably remain stuck in this low growth environment for years. Unfortunately, you cannot solve a problem of too much debt by encouraging even more borrowing; yet policymakers are trying to fix this mess by lowering interest rates and injecting liquidity.

Figure 1: Global stock of debt outstanding (US$ trillion)

Source: McKinsey & Company

Make no mistake, the US housing boom and subsequent financial crisis of 2008 were caused by the Federal Reserve's easy monetary policies which were put in place after the TMT bust. By dropping rates to emergency levels and keeping them there for years, Mr. Greenspan spawned the US housing bubble which almost destroyed the world's banking system. So, by keeping its Fed Funds Rate at zero since late 2008, it is ironic that the Federal Reserve is (once again) walking down the same path!

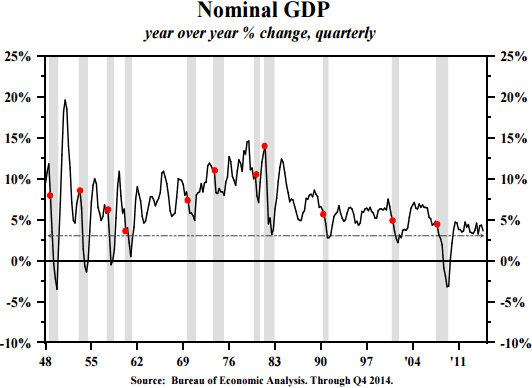

It is notable that even though the Federal Reserve's monetary policy has been extremely accommodative since the global financial crisis; the recovery in the US has been sub-par when compared to the previous economic cycles (Figure 2).

This is due to the fact that despite the carrot of record-low borrowing costs dangling in front of them, American households have refused to take the bait. Instead, they have done the sensible thing and deleveraged their balance-sheets.

Figure 2: US nominal GDP (1948-2014)

Source: Hoisington

Today, the household debt to GDP ratio in the US is 80%, well below the 100% level reached in 2008. This meaningful decline demonstrates that the Federal Reserve's ultra-accommodative monetary policies have done very little in terms of boosting household borrowing and consumption.

Instead, by dropping short-term rates to zero and keeping them there for 7 years, this time around, the Federal Reserve has succeeded in spawning new bubbles in the corporate sector, which pose a serious threat to the economy. Presented below is a list of the obvious corporate bubbles:

US Corporate debt - US$5trillion (+ US$2 trillion since 2007)

High yield (junk) bonds and leveraged loans - US$2.2 trillion (+ US$1.2 trillion since 2007)

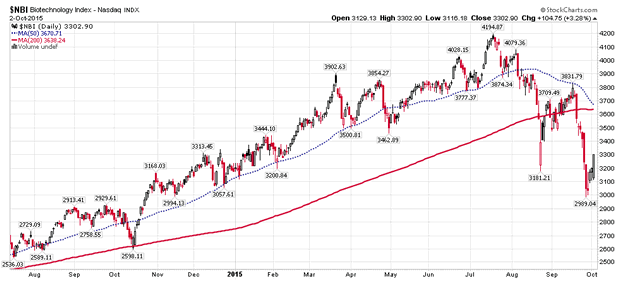

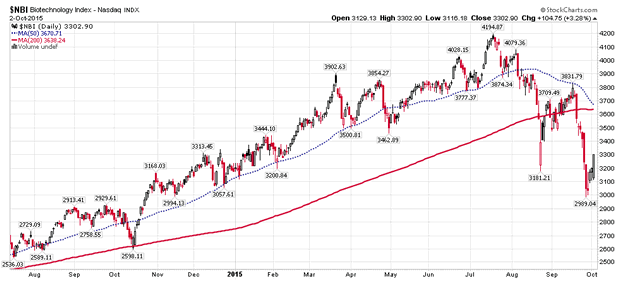

Biotechnology - 7-fold increase in NASDAQ Biotech Index; most companies have no earnings

In addition to the above excesses in the corporate world, the Federal Reserve's zero interest rate policy (ZIRP) has also blown the following domestic bubbles:

Student loans - US$1.2 trillion (+ US$0.7 trillion since 2007)

Auto loans - US$1 trillion (+ US$0.4 trillion since 2009)

Last but not least, the Federal Reserve's monetary policy has also inflated these international bubbles:

Commodities boom and subsequent bust

Commodities exporters' boom and bust (Australia, Brazil, Canada and Russia)

Singapore property

Stock markets of Indonesia, Philippines and Thailand

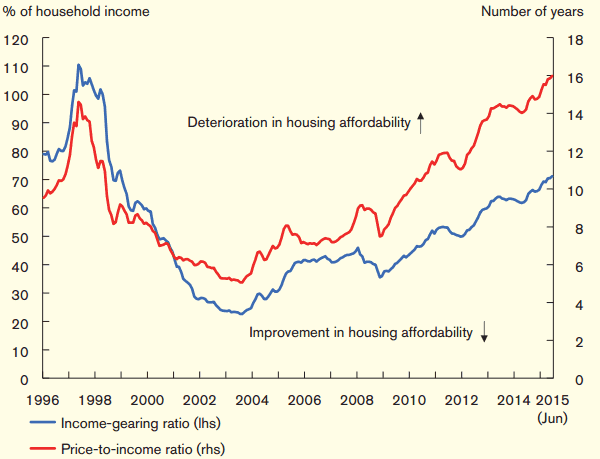

Hong Kong property - HK$1.044 trillion mortgage debt (+ 76% since 2009)

In terms of the Hong Kong property market, although most experts and talking heads on TV remain convinced there is nobubble, research from the Hong Kong Monetary Authority (HKMA) shows that housing has become extremely unaffordable. If you review Figure 3, you will note that the housing price-to-income ratio has now risen to a record high of 15.9 and it is even higher than the 1997 peak of 14.6. Meanwhile, the income-gearing ratio has increased further to 70.7%, well above the long-term average of 50%. According to the HKMA, if the mortgage interest rate returned to a more normal level, say an increase of 300-basis points, the income-gearing ratio would soar to 95%!

Figure 3: Indicators of Hong Kong housing affordability

Source: Hong Kong Monetary Authority

Today, many Wall Street firms, prominent hedge fund managers and academics are putting forward arguments as to why the Federal Reserve should not raise the Fed Funds Rate. In their eyes, the macro-economic conditions are too uncertain to even warrant a 25bps rate hike.

In our view, these folk are dead wrong because unlike Europe and Japan, the US economy does not need ZIRP. If our assessment is correct, the longer the Federal Reserve stays on hold, the bigger will be the eventual bust.

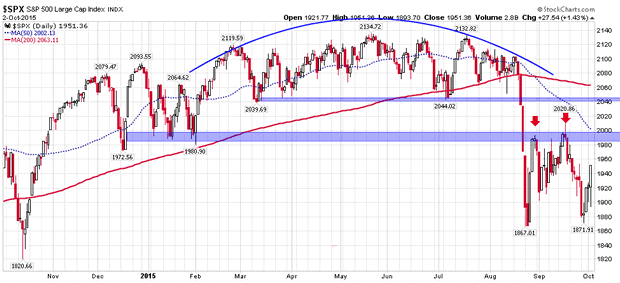

Turning to the stock market, it is our contention that the bull market on Wall Street ended in May and we are now in the early stages of primary downtrend. You will recall that the US stock market fell sharply in mid-August and since then, it has gyrated within a wide trading range. To the casual observer, these wild swings may not make much sense but closer inspection reveals that there is indeed a method to the stock market's madness.

If you review Figure 4, you will note that between late February and early August, the S&P500 Index carved out an enormous rounding top formation; which culminated in the plunge below the key support levels (shaded areas on the chart). Thereafter, in late August, the relief rally faded around the lower support (now resistance) level. The S&P500 Index then spent two weeks in a sideways grind and the next rally attempt also ended at the same overhead resistance. Following this failed rally attempt, the S&P500 Index re-tested its August low and over the past few trading sessions, it has put together another advance.

Figure 4: S&P500 Index (daily chart)

Source: www.stockcharts.com

At this stage, nobody knows when this bounce will end but if we are in a primary downtrend, the rally should fade around overhead resistance level (2000-2040). Under this scenario, the next leg down will probably take out the August-low and trigger a waterfall decline. Currently, we cannot guarantee how low the S&P500 Index might fall; but we see support in the 1,700-1,740 area. So, if our bear market hypothesis is correct, then the ongoing rally will end soon and give way to the next wave of selling.

Look. There are no certainties when dealing with the future, but our work leads us to believe that the bull market is now in the rear view mirror and the odds of new highs over the following months are slim to none. Our bearish prognosis stems from the following data points:

S&P500 Index is below the 50-day and 200-day moving averages which are pointing down

NYSE Advance/Decline Line peaked in April (prior to the stock market peak in May + July)

Our proprietary trend following filter is now flashing 'downtrend'

NYSE Bullish Percent Index has dropped to just 31%

The High yield (junk) bond ETF has taken out the August-low

Only 22% of the NYSE stocks are trading above the 200-day moving average

Biotechnology - The leading sector of the bull-market has topped out (Figure 5)

Russell 2000 Small Cap Index and Russell 2000 Growth Index have taken out the August low

Out of the 35 industries we monitor, just 6 are trading above the 200-day moving average

Leading stocks are declining on good 'news', indicating the best has been discounted

Stocks are declining despite ongoing QE in Europe and Japan

Stocks are declining despite no rate hike and a 'dovish' Federal Reserve

Volume is rising on down days and falling on up days

Bearing in mind the above price and volume data, we are almost certain that the primary trend for equities is now down and global stock markets remain vulnerable to heavy declines.

Figure 5: NASDAQ - Biotechnology Index

Source: www.stockcharts.com

Given the weak technical picture and worsening economic backdrop, we currently have no exposure to risky assets (commodities, high yield debt and stocks). Instead, we have invested our managed capital in the following manner:

Long dated US Treasuries & Zero Coupon Bonds - 40% allocation

Short-term US Treasuries - 35% allocation

Short positions (biotechnology, industrials and technology) - 15% allocation

'Long' US Dollar position - 5% allocation

US Dollar cash - 5% allocation

If our analysis of the situation is even vaguely correct, our managed portfolios will do well in the looming deflation and our strategy should outperform our benchmark (MSCI AC World Index) by a wide margin. Conversely, if stocks continue to rally (unlikely scenario) and our primary trend filter flips to 'uptrend', we will promptly re-position our managed accounts.

Puru Saxena is the CEO of Puru Saxena Wealth Management, his Hong Kong based SFC regulated firm which offers discretionary portfolio management and research services to individual and corporate clients. The firm manages two trend-following strategies – Discretionary Equity Portfolio and Discretionary Fund portfolio. In addition, the firm also manages a Discretionary Blue-chip Portfolio which invests in high-dividend world leading companies. Performance data of these strategies is available from www.purusaxena.com

Puru Saxena also publishes Money Matters, a monthly economic report, which identifies trends and highlights investment opportunities in all major markets. In addition to the monthly report, subscribers of Money Matters also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2015 Puru Saxena Limited. All rights reserved.

NYSE Advance/Decline Line peaked in April (prior to the stock market peak in May + July)

Our proprietary trend following filter is now flashing 'downtrend'

NYSE Bullish Percent Index has dropped to just 31%

The High yield (junk) bond ETF has taken out the August-low

Only 22% of the NYSE stocks are trading above the 200-day moving average

Biotechnology - The leading sector of the bull-market has topped out (Figure 5)

Russell 2000 Small Cap Index and Russell 2000 Growth Index have taken out the August low

Out of the 35 industries we monitor, just 6 are trading above the 200-day moving average

Leading stocks are declining on good 'news', indicating the best has been discounted

Stocks are declining despite ongoing QE in Europe and Japan

Stocks are declining despite no rate hike and a 'dovish' Federal Reserve

Volume is rising on down days and falling on up days

Bearing in mind the above price and volume data, we are almost certain that the primary trend for equities is now down and global stock markets remain vulnerable to heavy declines.

Figure 5: NASDAQ - Biotechnology Index

Source: www.stockcharts.com

Given the weak technical picture and worsening economic backdrop, we currently have no exposure to risky assets (commodities, high yield debt and stocks). Instead, we have invested our managed capital in the following manner:

Long dated US Treasuries & Zero Coupon Bonds - 40% allocation

Short-term US Treasuries - 35% allocation

Short positions (biotechnology, industrials and technology) - 15% allocation

'Long' US Dollar position - 5% allocation

US Dollar cash - 5% allocation

If our analysis of the situation is even vaguely correct, our managed portfolios will do well in the looming deflation and our strategy should outperform our benchmark (MSCI AC World Index) by a wide margin. Conversely, if stocks continue to rally (unlikely scenario) and our primary trend filter flips to 'uptrend', we will promptly re-position our managed accounts.

Puru Saxena is the CEO of Puru Saxena Wealth Management, his Hong Kong based SFC regulated firm which offers discretionary portfolio management and research services to individual and corporate clients. The firm manages two trend-following strategies – Discretionary Equity Portfolio and Discretionary Fund portfolio. In addition, the firm also manages a Discretionary Blue-chip Portfolio which invests in high-dividend world leading companies. Performance data of these strategies is available from www.purusaxena.com

Puru Saxena also publishes Money Matters, a monthly economic report, which identifies trends and highlights investment opportunities in all major markets. In addition to the monthly report, subscribers of Money Matters also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2015 Puru Saxena Limited. All rights reserved.

Saturday, July 25, 2015

No fool-proof way to invest

Gerald AmbroseManaging director of Aberdeen Asset Management Sdn Bhd

WITH the increasingly pessimistic outlook for the world economy weighing heavily on global financial markets, what is an investor to do? Unfortunately, there is no fool-proof way to invest, and more often than not, skills for successful investing are gained from the benefit of hindsight, says seasoned fund manager Gerald Ambrose.

The managing director of Aberdeen Asset Management Sdn Bhd can attest to this. Relating his personal experience, he recalls missing out on the London property boom after having sold his property there a few years before prices peaked.

On a more formal front, he recollects that Aberdeen had appeared to be on the losing end when it did not go big into the dot-com boom in the 1990s. But in retrospect, it was spared when the euphoria fizzled out for the tech sector.

“There is no right or wrong rule in investing. There is also no one-size-fits-all approach and I have friends who have reaped good returns from investing in alternatives such as wine and art,” quips the affable fund manager.

However, some basic principles remain, like spreading your investments over several areas, he says.

And gold, it would appear, has a small allocation in the portfolio of many a successful investor.

“Many investors who I respect tell me that 10% to 15% of what you have should be invested in gold. This is really not to make more money, but as an insurance policy, given the scenario where unproven economic experiments, such as quantitative easing (QE), are being performed on paper money all over the world.”

He says gold could be one’s only store of wealth if QE efforts do nothing measurable for the real economy and render paper money worthless, However, don’t buy paper certificates entitling you to pieces of gold, but gold itself.

While gold prices are down from their peak of US$1,911 in 2011 on the back of a positive outlook on the US dollar, some think it has not lost its glitter.

At the time of writing, gold was trading at around the US$1,100 an ounce level.

This is because the commodity is seen as much more than a hedge against inflation and a weak dollar. Commodity prices are tanking because much of the world is suffering an economic slowdown, and this is where gold comes in as a safe-haven asset.

“If QE ends badly, currencies might be worth nothing. Gold could be priceless. So above not below US$1000 it is worth having some,” Ambrose says.

The other three main asset classes are equities, bonds and property.

With returns from bonds currently dismal, funds are moving into US Treasury Bills, Malaysian Government Securities and the likes of Japanese government bonds for the same reasons as investing in gold. They are all seen as safe-haven investments during economic uncertainty.

Ambrose joined Aberdeen in 2005 after it was selected as the country’s first foreign fund manager to have been awarded a domestic asset management licence. The fund management company is a unit of the UK’s Aberdeen group and has RM13.2bil assets under management locally. Aberdeen currently has US$7.1bil or RM27.01bil invested in Malaysian equities as a group.

In terms of returns, Ambrose says it has beaten the benchmark – the MSCI Malaysian equity index – by 3% on a three-year rolling average since it started a Malaysian country fund in 1997.

While the Malaysian chapter is focused on equities, Aberdeen has a network covering equities, fixed-income instruments and property globally.

As for equities, Ambrose subscribes to Aberdeen’s bottom-up approach. This is basically looking at individual companies rather than the industry in which that company operates or the economy as a whole.

On what to look out for in stock-picking, he says one factor is whether the company has a business plan that will provide profits in eight to ten years’ time. And it would be better if its business model had a competitive advantage over others. “Make sure the cash flow and balance sheet can fund its growth, and ideally, it should have some spare cash for dividends. If you have a stock and don’t sell it, the only benefit is the dividend you get.”

Liquidity in the system

Other things that matter is the management of the company; whether they understand what a shareholder is, and in the case of fixed income, whether the borrower understands the obligation of the coupon of its debts.

Sustainable investing is also playing a bigger role. “If you buy a stock that factors in environmental, social and corporate governance (ESG) issues into investment decisions, then you will find their prices going up.”

Taking a leaf from investment guru Peter Lynch, he advises investors to research before making an investment decision, as otherwise, it would be akin to playing poker without looking at the cards.

Macro-economy wise, he believes the QE programmes taking place around the world “would end up in tears and be bad for the capital markets.”

The bad news, he says, has yet to be fully discounted by the market and this is a function of ample liquidity in the system.

“Many stock markets, including Malaysia, are still looking far from cheap, going by adjusted price earnings charts over a ten-year period,” says Ambrose, who thinks that the Malaysian market may see adjustments to accommodate the current economic and political situation.

Because of the weaker ringgit, many Government-linked companies are reluctant to invest overseas and an unintended consequence of this is that they are crowding out the market more than before. This has made the local stock market more protected than others, and one reason why prices have not discovered their proper value, However, he contends that the situation is not as bad as it was during the financial crisis in 1997. Based on international reserves, the capital outflows had been largely from the capital markets. Malaysia’s terms of trade – exports minus imports – have remained quite resilient despite the weak ringgit, notes Ambrose.

On the FTSE Bursa Malaysia KL Composite Index which is trading at around the 1,729-point level, he says the company does not have a view on the index’s year-end target as Aberdeen does not follow trends. However, he concedes that the firm does not see triggers for a major bull run.

“Still, there are many good companies in Malaysia which are well-managed and have good cash flows, but to find them at a price that gives attractive upside is the difficult bit.”

Since the oil price decline in September, he says the fund has picked up a number of oil and gas (O&G) stocks which have dropped to valuations that it felt had genuine upside. It has added a couple of blue chips. Its current poftfolio has 45 listed companies on Bursa Malaysia.

Ambrose believes the O&G stocks it bought can withstand lower oil prices. Dialog Group Bhd, for instance, has done well as it is in fuel bunkering. Bunkering is in because oil is in contango right now. This means that the futures price is higher than the current price, resulting in demand for fuel storage space to store oil for future sales.

As for property, about 15% of Aberdeen’s group assets under management is invested in that sector. It has an Asia private equity division headquartered in Singapore, which has some investments in the Malaysian property sector.

On his personal investments, Ambrose has some European unit trusts invested via Aberdeen. These include a pool of companies listed in Europe like Nestle SA and Unilever, which have the bulk of their sales in emerging markets. He says he had taken advantage to invest in the parent companies of these multinationals, given that the ratings of these stocks have cooled down vis-a-vis their foreign units.

According to Ambrose, back in the 1990s, the price earnings ratio of Nestle SA was about 24 times yielding a return of 3%. Nestle (M) Bhd, meanwhile, was listed at eight times and yielded a return of 7%. The trend has come full circle, with Nestle SA trading at around 13 times to yield 6%, while in Malaysia, the stock is trading at around 29 times and yielding about 4.5%.

Ambrose has also invested in Aberdeen’s frontier market equity fund, which invests in countries like Sri Lanka, Pakistan, Vietnam, Myanmar and Nicaragua. Where alternative investing is concerned, Ambrose says often the best investments are the ones not bought for investment value but as things you like.

“Art in Asia is exciting but undervalued and under-invested. On the other hand, wine has caught up, with more people entering the market, particularly in China and Russia.”

Friday, June 26, 2015

The 4 Diseases of Investing

Teaminvest Co-founder Professor John Price, recently recorded an informative 4.5 minute video about the behavioural biases that often block rational decision-making about investments.

It’s titled “The 4 Diseases”. In the video he explains the four common behavioural biases and fuzzy thinking affecting the way we assess investments. He calls them:

Get even-itus

Consolidatus-profitus

Trade-a-filia

FOMO

Watch the video and see if you suffer from any of them? - Self awareness will improve your investment decision-making!

Click here to see video

NOTES: Stock selection - Read the annual reports - Read all the analysts reports - Visit the stores or use their products and services If you find that at the end of the day, the performance of the portfolio is not that good, or mediocre at best, in many cases there are various reasons. They often have not taken into account behavioural biases, the sort of fuzzy thinking that is automatically in their mind that blocks out their rational decision. These are the 4 behavioural biases, which we refer to them as: |

- Get even-itus

- Consolidatus-profitus

- Trade-a-filia

- FOMO

Get even-itus

The disease of hanging onto a stock when the price has gone down until you can get even. "Don't worry dear, it is going to come up back again." The problem is, if the stock has gone down, the chances are it is going to continue to go down and best it is going to be a mediocre investment. It is much better to face the fact that you have a loser, you lost money and to move on.

Consolidatus-profitus

This is the opposite to get even-itus. This is the disease of always taking a profit when the price goes up. It looks great and you can tell your friend at the dinner party that your stock went up 20%, 40% or 50% and you sold it. The problem is what you are going to do with that money. Studies have shown, on average, people who sell just to take a profit end up putting their money back into the market in a stock that underperforms the one they got out of. #

Get even-itus and Consolidatus-profitus are two sides of the one coin; generally hang on to losers and sell winners. The opposite would be better, that is, sell your losers and hold on to your winners. They water the weeds and cut the flowers. It would be better they water the flowers and cut the weeds.

Trade-a-filia

This is the disease of just loving to trade. Most people who would never dream of going to casino betting on roulette or any of the casino games or machines,yet when they are on their internet and looking at their stocks, they trade far too often. It is so simple to trade on the internet and they get drawn into it. But studies have shown that on average, the more a person trades they worse they do. I am not referring to their transaction costs but actually their performance diminishes. Instead of looking for great companies that are going to make you money year after year, they think they can get a short term profit. In the short term, the share prices are much more random than most people believe. So this is a disease of trading too often. In this regard, women are better investors than men, because overall, women trade less than men.

FOMO

This is the 4th disease, the FEAR OF MISSING OUT. You read about a particular stock and its price is going up and you think, if I don't get in now, I am going to miss out, instead of taking your time and evaluating the stock properly.

These 4 diseases really work together and at best give you a mediocre performance that is far far below you optimal performance.

You should work to eliminate these 4 investing biases or diseases, consciously. Use tight filters to filter out the best companies to concentrate in.

Be alert that you are not slipping into these investment biases. Eliminate these investing biases and your performance will be much better.

Source: http://myinvestingnotes.blogspot.com/2015/06/the-4-diseases-of-investing-evenitis.html

Friday, May 29, 2015

An Important Investment lesson - Koon Yew Yin

Practically all my wealth is from share investment and I have been trying to teach people how to invest by giving investment talks and publishing articles. My method of selecting shares is based on my entrepreneurship and not purely on accounting principles as I am not an accountant. That is how I bought so much of VS Industry and Latitude Tree. As a result, I become a substantial shareholder of these two companies.

The price chart shows that Latitude has gone up from Rm 1.00 to above Rm 6.00 in less than 24 months and VS has gone up from Rm 2.50 in January 2015 to the current price level of Rm 4.20 in less than 6 months. Basing on my business instinct, I believe the prices of these two stocks should go higher when the next quarter results are announced.

What is the most important lesson?

You must frequently look at company announcements and when you see any company showing a sudden jump in profit, find out more about the company. Look at their website and its profit growth prospect. That is how I discovered Latitude and VS. I also bought Lii Hen and Poh Huat when I saw their sudden jump in profit.

Similarly I bought into Supermax a few years ago. When I saw there was a sudden jump in profit for Supermax in February 2009, I started my buying. When I saw X ray detectors installed at the airport to prevent the spread of the deadly HINI virus, I bought more aggressively.

The chart below shows the price of Supermax shooting up from Rm 1.00 to above Rm 6.00 within a period of 15 months. People were then fearful of the deadly HINI virus. The demand of gloves far exceeded the supply. As a result, all glove manufacturers were reporting increasing profit every quarter.

Supermax annual report as announced on 8th April 2010 showed that my wife and I together with my nephew and my sister in law held a total of 19, 550, 000 shares. We bought Supermax instead of Top Glove because it was trading at a lower P/E ratio. Similarly VS is now trading at a lower P/E ratio than MPI and Globetronics.

How did I make a kill?

We bought so much Supermax shares within such a short period that its Executive Chairman and CEO, Dato Seri Stanley Thai invited me to visit their factory in Sg Bulou, Selangor to reassure me of my investment. He also wanted to know how and why I bought so mush of Supermax shares within such a short time.

I told him that as soon as I saw the annual report as announced in February 2009 that there was a sudden jump in profit, I started my buying and when I saw X ray detectors at the airport, I bought even more aggressively.

In July 2010 when the HINI fever was under control, I sold just as aggressively. That is how I made such a huge profit.

When to sell?

Statistics show that almost all short term traders lose money. I have told you how and when to buy and now I will tell you when to sell to make profit.

After you have bought, you must hold and sell only when you see the company reporting reduced profit over 2 consecutive quarters.

You must also sell when the criteria for you to buy is no longer valid. For example, although Coastal Contracts and Favco are still showing good quarterly profit, the demand for offshore vessels and cranes is severely affected due to the slump in the oil prices as shown on the oil price chart below.

I sold all my Favco shares a few months ago when I saw oil prices started falling.

I hope this lesson is useful to all investors. Now what you need is some luck and wait patiently to see your profit grow.

Tuesday, May 12, 2015

7 Lessons Fantasy Football can teach Stock Market Investors

There are a host of parallels between the world of sports and the world of investing — a wealth of performance statistics, endless predictions by brainless pundits, and superstar names that we adore one minute and ridicule the next.

Fantasy football is particularly apt for investing comparisons because you get to pick your own “portfolio” of players each week.

So as you finalize your lineup heading into Week 2, keep in mind these lessons, which can be applied to managing your money:

Do the research: The quality of your team starts and ends with how up-to-date your research is. It’s not just about who was injured last week, but also about knowing upcoming match-ups and taking advantage of them. Investors who simply step into Wall Street and start throwing money around can sometimes get lucky on gut feel, but long-term success — particularly when challenges arise — requires work and foresight.

Predictions aren’t guarantees: Of course, some of the headlines out there are simply projections of what’s expected, not hard facts. In these cases, it pays to have a healthy dose of skepticism and independent thought when crafting either your fantasy roster or your investing portfolio. The quality and trustworthiness of the information source matters, but unfortunately, even the best pundits can be wildly in error when the unexpected happens.

Be wary of fads: In fantasy football, as in the stock market, there are always bizarre breakouts that captivate the masses. For instance, in standard leagues, the No. 2 scoring receiver in week 1 was an undrafted rookie for the Jacksonville Jaguars. But look deeper and you’ll see that the team’s top receiver was injured, and that Jacksonville still is arguably the worst offense in the NFL — so what’s all the fuss about? Every once in a while you might see an unknown stock pop and start to grab headlines. But before you buy, look beyond the short-term trend and think critically about the real chance of success in the long run.

You only have so many roster spots: Along the same lines, it’s important to remember you have a fixed set of roster spots in fantasy sports, so any hot fad has to come at the expense of another position. In the same way, most investors don’t have unlimited liquidity, and choosing a new stock often means you have to cut another position or deploy the limited amount of free cash you had socked away. Economists like to call this the “opportunity cost,” or the price you pay for choosing one option above other opportunities that may serve you better. Finding new opportunities is nice, but there are always alternatives, including the option of simply doing nothing.

Protect yourself and diversify: In sports, as in the market, things never quite go as planned. That’s why it’s important to protect yourself. Some fantasy owners keep the backup to their star player on the bench too, just in case of injury. Others aren’t afraid to keep two QBs on the roster and switch back and forth based on how the season progresses. This kind of agility is an important hedge against the unexpected, and something investors should consider for their portfolio. If your success hinges on a few star stocks driving the bulk of your returns, that’s a dangerous position to be in.

Don’t make excuses for poor performance: Last year, I had Eli Manning as my fantasy quarterback for the first few games. After eight interceptions over just five TDs in the first three games, I had to kick him to the curb. Good thing, too, because later in the season he threw five picks in one game! It’s hard to admit you made a mistake, and when there are no great alternatives, it’s easy to talk yourself into sticking with a loser. But sometimes the poor performers simply don’t bounce back, and waiting patiently for stocks like Radio Shack or Lululemon to bounce back becomes an even worse mistake than simply cutting your losses and moving on.

Don’t gamble your way to retirement: At the end of the day, I’m comfortable with all my fantasy-football foibles because it’s just a game to me. Sure, I lose a hundred bucks or so each year, but I plan my budget accordingly and I’m no worse for the wear. If I treated each league as an income source, plowing in big bucks every season and relying heavily on the chance of my winning, that would be incredibly irresponsible. Investors should view the stock market in the same way because day-trading small-caps or betting on speculative penny stocks can be a fun diversion, but is no way to reliably provide for your family or plan for retirement. The sad reality is that becoming a millionaire picking stocks is much like becoming a millionaire playing fantasy football — possible in theory, but not a practical path for most people. Stick to index funds, and make sure you’re not playing for high stakes you can’t afford.

Monday, April 27, 2015

Clueless About Stock Investing? Get Started With These Essential Stock Investor Tips

Many people start their life as a stock investor the wrong way. It happened to me. Everyone I knew were making lots of money in the market. I thought it was so easy to make money just by listening to market tips. But the truth will always reveal itself when the market correct. It become clear that the only thing easy is how easily your money can disappear there.

These are wrong ways to start your journey as a stock investor. It is not too late to change. To start off on a sound footing you will need to have some tried and tested techniques before participating in the stock market.

It could be bit technical for some people to understand, so let’s break it down.

Master These 10 Techniques Before Becoming A Stock Investor.

1) Education

Most people need a proper education before they can find success in whatever they do. The same with the stock market. If you are looking to become a stock investor then the first step is looking for a stock investing education.

Learn about how to analyse a company businesses and calculate the real worth of a business. Have a proper education before starting your stock investor journey.

2) What Stocks To Buy?

There are thousands of stocks listed in the stock market. The most popular stocks are dividend stocks, growth stocks blue chips and penny stocks. If you are a stock investor you will look for stocks that have potential for capital gains (rising share prices) and giving good dividends.

The stocks can only do that if they have a good business and continue to generate good profits every year. On the other hand, penny stocks can offer massive capital gains (much more than good stocks) but these gains are not sustainable because they are due to speculation. What stocks to buy? The choice is yours.

3) How Much Capital To Invest?

Decide early on how much capital to put into stock investing. If you have $50k savings you should not be putting all of the $50k in the stock market.

Keep at least 30%-40% for personal emergencies and some cash into an “Opportunity Fund” if the market corrects. Don’t put everything in the stock market!

And above all, don’t use margin finance and loans to invest in the stock market. It can hurt your finances badly if the market decide to drop.

4) Is It The Right Time To Start Investing?

Although many people think that long-term investors need not time the market won’t it be nice if you started when the market is at a low point rather than at all-time high? What cycle is the market right now? Have you heard of the Malaysia stock market investing cycle? This phenomenon comes around every 10 years in Malaysia. Knowing this beforehand could make you a richer stock investor.

5) Spare Time

Having enough spare time is a critical element in stock investing. If you have limited spare time then you have to be a passive investor and cannot be an active or aggressive participant in the stock market.

It is because spare time is needed to conduct many activities such as stock research, read up on news, look at stock charts, monitor stock prices and ongoing learning to upgrade your skills and knowledge.

Stock investing is a serious business where you are learning something new everyday. Many stock investors ignore this to their peril.

6) Good Resources

Good resources refer to the guidance and information you will need to keep your stock investing up to track. Is it a stock market blog, money magazines, authoritative stock market websites or a stock market group you can join? The purpose is to gain reputable news and in-depth knowledge about the stock market.

7) Online Account

A good online account helps an investor make better investing decisions. It should have adequate online security, offer low trading commissions and tools to help the stock investor to make good decisions on purchasing and selling stocks. Choose an online account wisely because it is an asset to a stock investor.

8) Age Factor

Are you 30 or 50 years of age? A 30 something person have a different set of investing strategies compared to a 50 year old looking to accumulate enough money for retirement later.

Unfortunately you can see there are many people in their 50 investing in the stock market like a 30 year old. They aggressively purchase speculative stocks with their savings hoping for a big gain.

It is the wrong way to investing as stock investor in their 50 should NOT be speculating but instead using passive low risk investing strategies to increase their incomes.

9) Paper Trading

Many people skipped this process called the “testing period” and regret it later. It is a time where you go LIVE and test out your investing strategies to see if they work in real life or not. In USA, they call this “paper trading” which the account is loaded with virtual money.

In Malaysia, you don’t have it yet. But you can always make a trade on paper and keep track of this. If you are not making money investing in a virtual account, there is a big chance you will also lose money in a real trading account.

10) Knowing Yourself

Many people who failed say that they failed because they could NOT keep their emotions in check. In the stock market your true character will reveal itself, trust me. If you are greedy in the stock market, it is because you are greedy in your real life.

Learn more about yourself before you start investing. Learn all your strengths and weaknesses and how to overcome them. In the stock market you are your own demons. Knowing yourself beforehand will make you a better stock investor later.

Conclusion

Many stock investors start their investing journey the wrong way. They end up losing badly in the stock market and they blame the market for being a scam.

However, it is not too late to change all the wrong ways. Things can easily be fixed with the proper training and education. Mastering some tried and tested techniques before you start investing can help you to the right footings to investing success later.

Saturday, April 25, 2015

The Coffee Can Portfolio

If I were given $10,000 today, how would I invest it? I would build a coffee can portfolio. As you’ll see, it is an elegant and simple solution to a set of knotty problems.

Those problems are largely behavioral issues of our own making. For example, most investors tend to buy high and sell low, the opposite of what you should do.

One of my favorite stories in this regard involves Ken Heebner’s CGM Focus Fund. It was the best U.S. stock fund of the decade ending in 2009. The Focus Fund earned 18 percent a year for its investors, beating its nearest rival by more than three percentage points. Yet according to research by Morningstar, the typical investor in the fund lost 11 percent annually.

How? Investors tended to take money out after a bad stretch and put it back in after a strong run. They sold low and bought high. Incredibly, these people found the best fund you could own over that decade and still managed to lose money.

This is all too common. Investors are bad at timing their buys and sells. People get emotional. They chase hot stocks. They can’t wait to grab gains. They’re impatient and too focused on short-term results.

Also, most people trade way too much. All that activity smothers their returns. Brad Barber and Terrance Odean showed this in a famous 2000 paper titled “Trading is Hazardous to Your Wealth.” Their conclusion: “Individual investors who hold common stocks directly pay a tremendous performance penalty for active trading.”

All this trading incurs costs. You pay commissions, which are often slight but can still add up. You pay bid-ask spreads. You pay taxes. (Although you can shield this liability in a tax-free account.) You pay fees if you invest in any mutual fund. These fees go a long way toward explaining why most mutual funds have trouble beating an index like the S&P 500.

In short, the way most people invest is the exact opposite of what you should do. As Jerry Seinfeld told George Costanza: “If every instinct you have is wrong, then the opposite would have to be right.”

Which brings us to the coffee can portfolio.

A money manager named Robert Kirby came up with the idea in 1984. He wrote about it in an essay for the Journal of Portfolio management. In it, he tells the story of how he managed the portfolio of one client for about 10 years, and then her husband died.

She inherited his estate and told Kirby she would add his portfolio to her own. Kirby saw the list of stocks in the husband’s portfolio and wrote, “I was amused to find that he had secretly been piggy-backing on our recommendations for his wife’s portfolio.”

But then he saw something that shocked him. The husband had followed Kirby’s advice – with a twist. “He paid no attention whatsoever to the sell recommendations,” Kirby wrote. “He simply put about $5,000 in every purchase recommendation. Then he would toss the certificate in his safe-deposit box and forget it.”

Well, the results were quite interesting. The husband had a number of small stocks worth less than $2,000. But he also had several worth more than $100,000. And he had one holding worth more $800,000. This one holding alone exceeded the value of his wife’s entire portfolio. It was humbling for Kirby, as you might well imagine.

Hence, the idea of the coffee can portfolio. The strategy simply amounts to buying stocks and socking them away in a proverbial coffee can for 10 years. Kirby explains that the idea harkens to the Old West, when people used to put their valuables in a coffee can and hide it somewhere.

The success of this portfolio depends entirely on what you initially put it in. This reduces the investment problem down to its core. What should you buy knowing you can’t sell it for 10 years? My hunch is with a little reading and thinking almost anyone can come up with a promising list of five to 10 stocks.

Make sure you own a variety. If you pick just five, make sure they aren’t all oil stocks, for example. You also want to avoid faddish stocks or things that look like they might not be around in a decade.

It’s not easy. But it removes a lot of the obstacles that prevent people from doing well. There are no transaction costs after you set one up. There are no capital gains taxes to pay. There are no investment advisers to pay, either. (Thus it will never be popular with investment professionals). There is no trading, no fiddling around trying to buy low and sell high. You simply decide what goes in the coffee can today and then you go on about your life. Open in 10 years and see what you have.

Tuesday, April 21, 2015

KLCI 10 Year Cycle

All markets have cycles. They will go up, peak, go down and then bottom. When one cycle is finished, the next one begins.

The same theory apply to our stock market. It is a fact in the stock market investing cycle, the key to making big money is to buy at the bottom and sell what you have at the peak.

Those who have experience with stock market investing know the boom and bust cycle the stock market goes through in Malaysia. Many analysts have their own time frame of the stock market investing cycle; some say 3 years, others say 5 years but to me, I can vouch for the KLCI 10 years calendar cycle. Let me explain in-depth with some events that had affected the Malaysia stock market in the past.

History of the KLCI

The modern day Stock Exchange of Malaysia was formed in 1964 and I have below, each of the 10 calendar year boom and bust stock market investing cycle which happened.

1960 – 1970

1969 – May 13 race riots in Kuala Lumpur sent the stock market crashing!

1971 – 1980

1974 – Arab oil embargo making oil prices shoot to all-time highs. This cause stock markets all over the world to crash due to very expensive oil.

1981 – 1990

In this period there were 2 major bust and 1 minor bust stock market investing cycle.

1985 – The Pan Electric crisis which saw the stock market close for 3 days and sending the market into a tailspin.

1987 – US Dow Jones Black Monday stock market crash. When the US market crash, our market followed them down!

1989 – China Tiananmen Square protests leaving hundreds dead and thousands arrested in China. Our stock market dropped sharply in sympathy with the protests and chaos.

1991 – 2000

In this period there was 1 minor bust and 1 major bust stock market investing cycle.

1991 – 1st Gulf War, Operation Desert Storm – it cause oil prices to spike and later stock market dropped sharply because of the war lead by the US against Iraq.

1998 – Asian Financial Crisis. Many companies suffered heavily and the stock market crashed leaving most investors with heavy losses. The worst stock market crash I’ve experienced since 1987.

2001 – 2010

In this period there were 2 major busts and 1 minor bust stock market investing cycle.

2001 – Sept 11 Twin Towers terrorist attack in New York. This lead to the near collapse of the US stock market due to panic selling from the attacks. Unfortunately, our market followed them down!

2003 – US invasion of Iraq. It cause the Middle East area to heat up and lead to high oil prices. Our stock market dropped sharply.

2008 – US Subprime Financial Crisis leaving many US banks and brokerages bankrupt. Our stock market followed the US down in a major correction!

What will Happen in the Next 10 Years?

Ever since the last major bust in the 2008 US sub-prime crisis, the market have been on the boom cycle. So now is 2015! ... and we had 6 years of stock market boom cycle without a major crash.

If you believe the 10 year boom bust stock market cycle theory, you know the boom cycle will end some day. So don't be surprised one day within this 10 calendar year, the stock market will experience a major crash as part of the investing cycle. Be prepared!

Subscribe to:

Posts (Atom)