In line with the Wyckoff accumulation schematic, the selling of FBM KLCI was well absorbed and hence was accumulated since the selling climax in Aug 2015, which indicates FBM KLCI has successfully formed a bottom for the 2 years correction (Jul 2014 to Aug 2016).

Today, FBMKLCI managed to close above 1681 to violate the downward trend-line shown in the figure.

Given that FBMKLCI is now trading well above the 200Sma, FBMKLCI is poised to regain strength to turn bullish again.

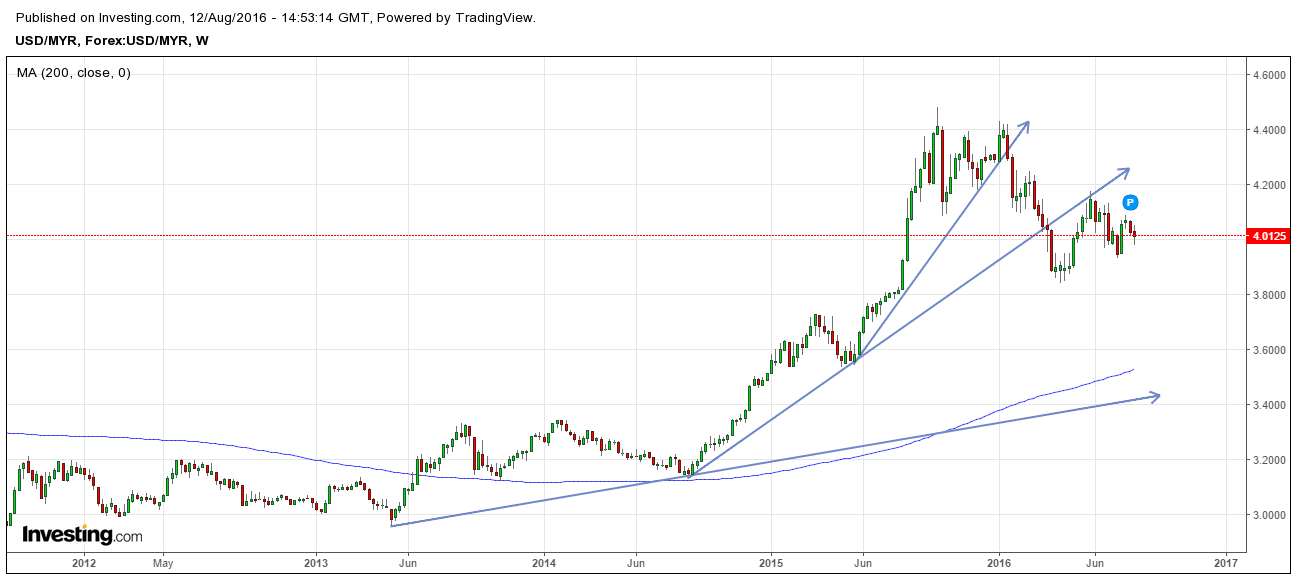

This is the weekly USD/MYR currency chart. Just to clarify in case if you are unfamiliar with currency chart, up move in USD/MYR means Ringgit is weakening, equivalent to US dollar gaining strength, and vice versa.

In the chart above, Ringgit has weakened against US dollar from May 2013 to Oct 2015.

The chart above clearly highlights the Bump and Run Reversal chart pattern formed on USD/MYR currency pair. This means the weakening of Ringgit against US dollar has reached an end for intermediate to long-term (1 year), and Ringgit has successfully retested the middle trendline in June 2016.

The is the USD/MYR chart but zoomed in onto the daily candlesticks of USD/MYR chart spanning from Jul 2015 to Aug 2016.

As we can see, the downward trendline for the USD/MYR is getting steeper, so we can expect an accelerated sell down of US dollar against Ringgit in future.

So what does all these currency charts suggest?

These signals from the currency charts conveyed a clear message that Ringgit will strengthen moving forward.

So how does all these related to FBM KLCI and Malaysia stock market?

If Ringgit were to strengthen against US dollar, it means the foreign funds will be revisiting our market soon after the 2014 and 2015 capital exodus, and we will see the return of bull market.

Disclaimer: This is an expression of personal opinion of the author, the author is not responsible for anything happened to the readers after they read this post.